Diana Marszalek 28 Feb 2022 // 12:33PM GMT

WASHINGTON — Washington’s high-powered lobbying firms — including Omnicom's Mercury Public Affairs and Publicis Groupe's Qorvis — have dropped lucrative contracts with Russian clients in keeping with US sanctions against the companies.

CNN reports that at least six firms representing the interests of Russian banks and companies have severed those ties since the sanctions were imposed last week, after Russia invaded Ukraine.

Those firms include Omnicom-owned Mercury Public Affairs, which terminated its contract with Sovcombank. The bank had hired the firm for $90,000 a month in January in a bid to be spared sanctions, CNN reported.

Mercury also dropped energy and mining conglomerate EN+ Group, the majority of which was owned by Russian oligarch Oleg Deripaska.

Mark McCall, global head of FTI Consulting's strategic communications segment, confirmed that FTI has terminated its relationship with Russia's largest bank, Sberbank, whose European subsidiaries face failure due to the sanctions.

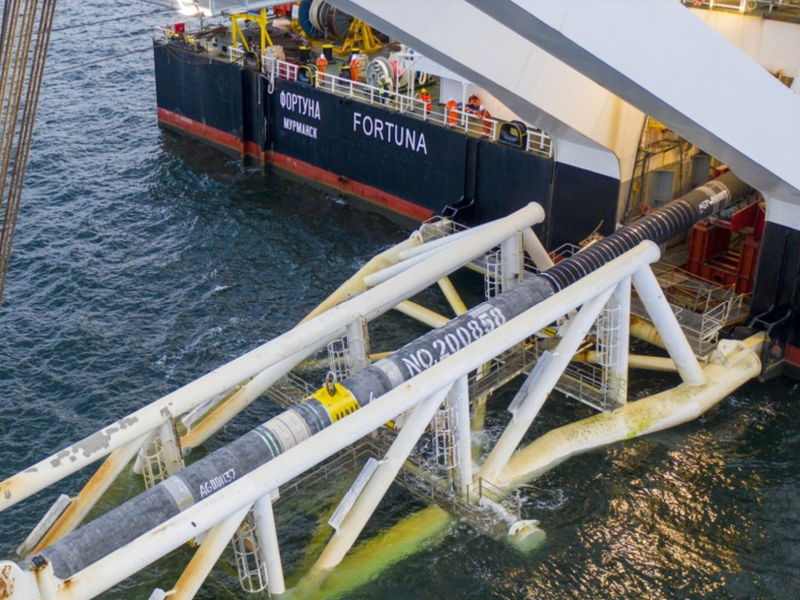

Roberti Global and BGR Government Affairs have ceased their work with Gazprom’s Nord Stream 2 AG, parent company of the Russia-to-Germany Nord Stream 2 natural gas pipeline.

Politico, which first reported the news, said Nord Stream 2 AG paid Roberti Global more than $9 million for lobbying since 2017, one of recent year’s largest lobbying deals. It paid BGR $2 million over the last two years, including $420,000 in 2022, government lobbying disclosures showed.

McLarty Inbound also stopped its pipeline-related work, dropping five companies that had invested in Nord Stream 2, CNN reported, business that earned the firm $3.5 million since 2017.

Sidley Austin, meantime, ended its relationship with VTB Bank, Russia’s second largest financial institution. The lobbying and law firm earned more than $2 million from VTB since 2015.

Venable is no longer working state-run Sberbank, which paid the firm $240,000 last year to monitor sanctions-related issues, Politico reported. And Qorvis' Geopolitical Solutions has dropped state-run Vnesheconombank.

Erich Ferrari, an attorney who specializes in US economic sanctions, told CNN that dropping contracts with sanctioned banks "is not a gesture in solidarity with Ukraine, this is a requirement under US law.”

However, firms that continue to represent Russian companies that aren’t fully sanctioned are putting their reputations at risk, sources said.

"For Russian clients, they’ll be assessing sanction status, primarily, and payment history," said former Ketchum Europe CEO David Gallagher. "These clients are presumably in energy or tech sectors, so the agencies may be able to make ethical decisions on the basis of practical constraints."

"And there will be questions about clients sitting outside Russia but drawing Russian investment, and what to do about them. Sanctions may be less clear for them, and ethics less of a factor. Then there are international clients being served in Russia. It’s going to be hard to get paid there for a while."

In 2020, the Russian government installed new leadership at Rossotrudnichestvo, the state agency responsible for overseeing foreign aid and cultural exchange, in an attempt to build "soft power" and boost its image amid global criticism.

The move came after many international PR networks stepped back from Russia in recent years, both in terms of a presence in the country and working with Russian firms.

Portland, for instance, ended its relationship with Russia in 2014, while sister Omnicom agency Gplus (which was merged into the Portland brand last year) stopped working with the Russian government in 2015 and with natural gas giant Gazprom – Russia's largest company – in 2017.

Ketchum also ceased representing Russia in the US and Europe in 2015, although it still operates a substantial Moscow office. Grayling has a presence in both Russia and Ukraine, as does PBN Hill+Knowlton Strategies. FleishmanHillard also operates in Russia as FleishmanHillard Vanguard.

Additional reporting by Maja Pawinska Sims

.jpg)