Arun Sudhaman 18 Oct 2021 // 5:45AM GMT

The global PR industry is facing challenges in terms of talent and hybrid working models, according to the fifth wave of global PR industry research carried out by PRovoke Media, ICCO, APACD and research platform Stickybeak over the past six weeks.

The study, which attracted 156 respondents from across the globe, also found remarkable positivity about the pandemic's impact on the business outlook, following on from the strong industry recovery predicted in the preceding wave of research in April.

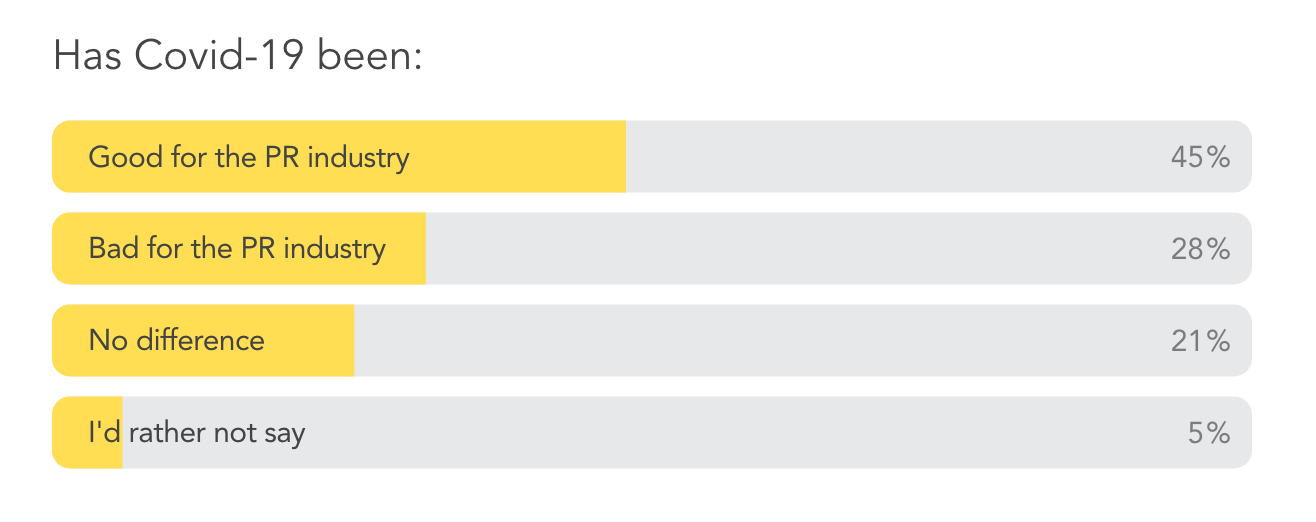

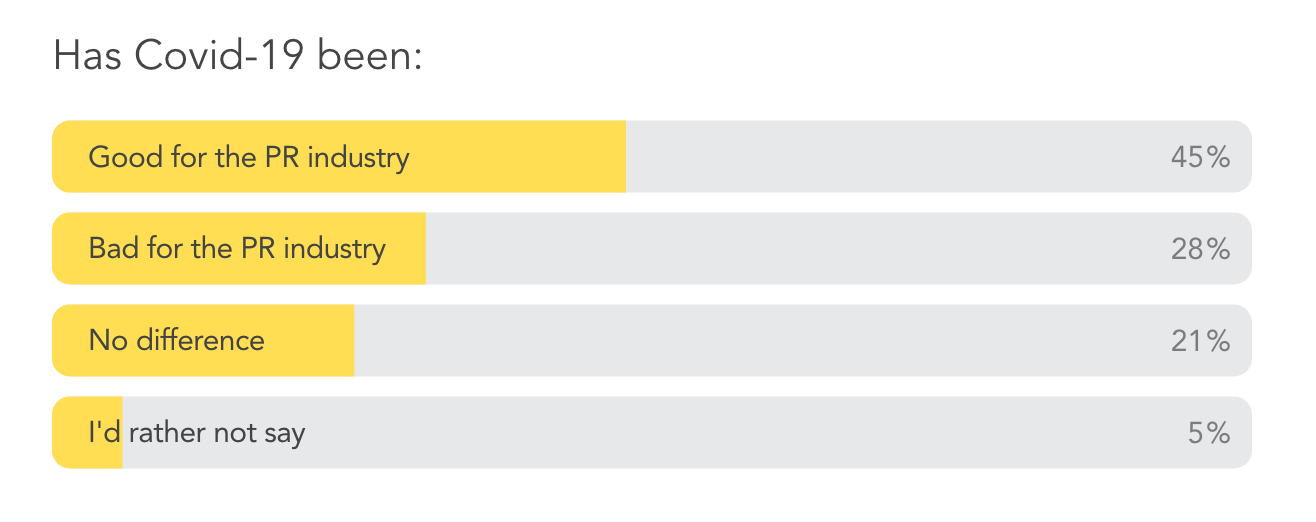

45% of respondents describe Covid-19 as 'good for the PR industry', compared to 28% who see a negative impact. And that positivity no doubt stems from the business outlook.

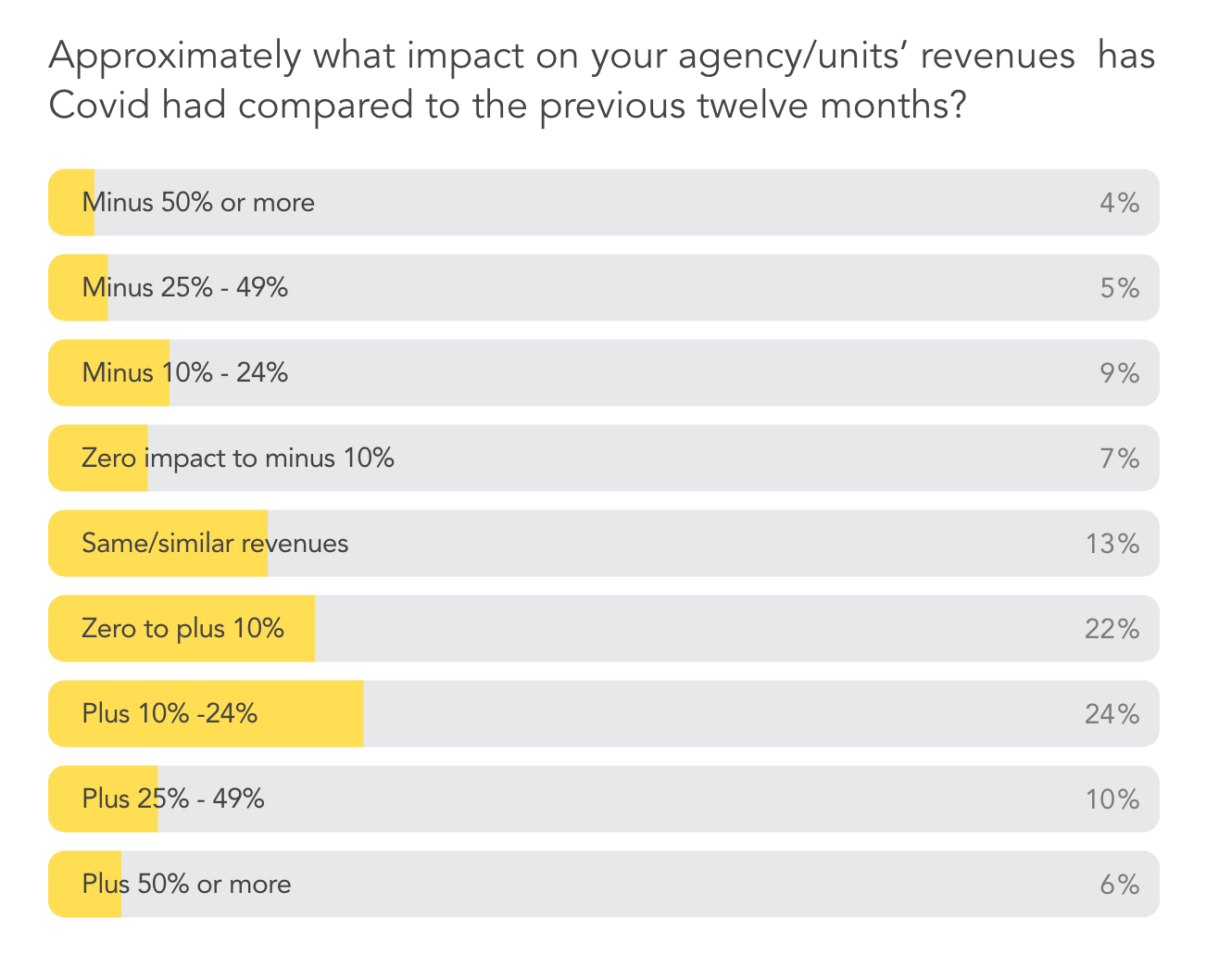

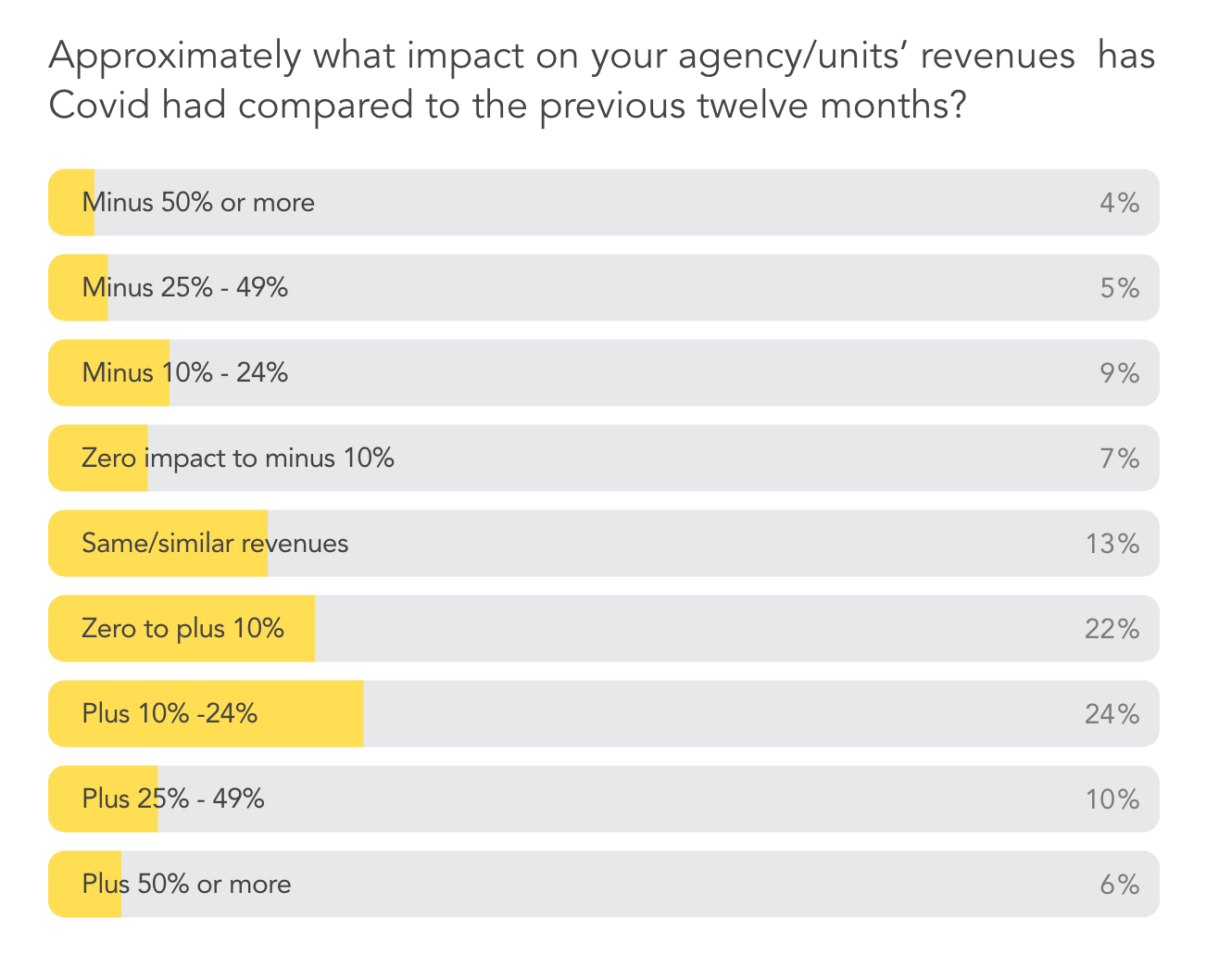

Almost two-thirds of respondents (62%) report a positive revenue impact compared to the previous 12 months, with four in 10 revealing double-digit expansion.

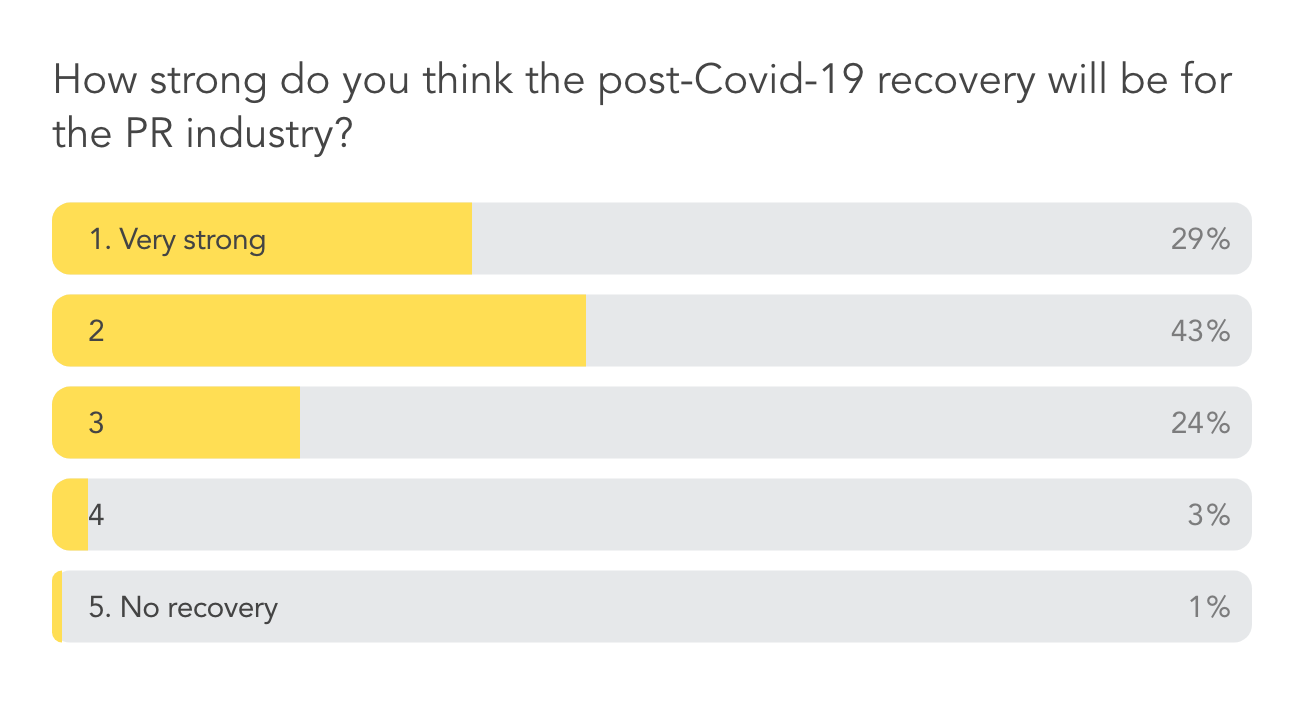

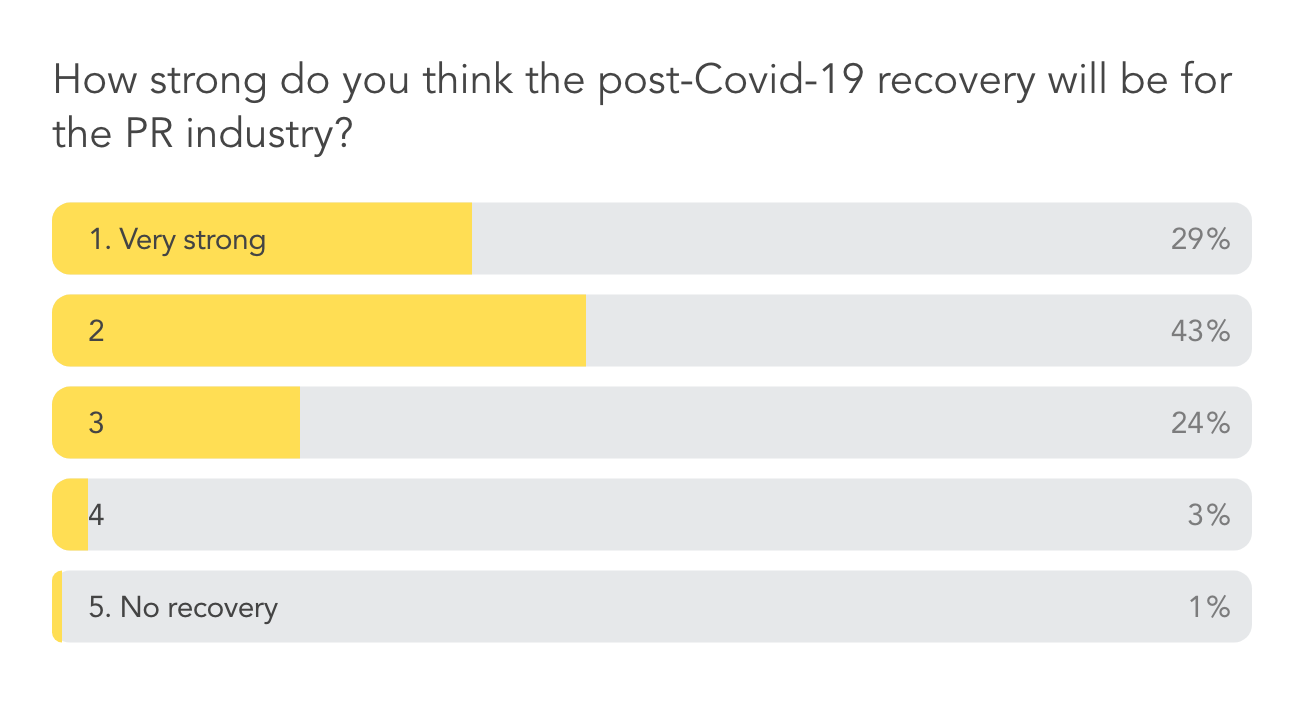

72% of the industry expect a strong post-pandemic recovery, compared to just 4% who are bearish. That represents a significant improvement on the optimism that had already taken root six months ago.

"Remarkably, 45% of the PR agency leaders think the pandemic has been good for the industry," said Stickybeak co-founder David Brain. "Perhaps this is some form of Stockholm syndrome, but possibly it is due to the elevation of the discipline during crisis times when PR gets a seat at the top table.

"Hopefully this incredible confidence means that more agency and in-house leaders have hung on to that position even after the worst of the pandemic has passed," added Brain. "It would be good news if Covid has hard-wired more of the industry’s leaders into boardrooms and CEO offices."

The findings provide further confirmation of how the pandemic has reinvigorated demand for such services as corporate communications, crisis counsel and employee engagement, and underpinned sectoral growth in healthcare, B2B and technology. In addition, it appears that a consumer marketing rebound is underway.

Workplace & talent challenges

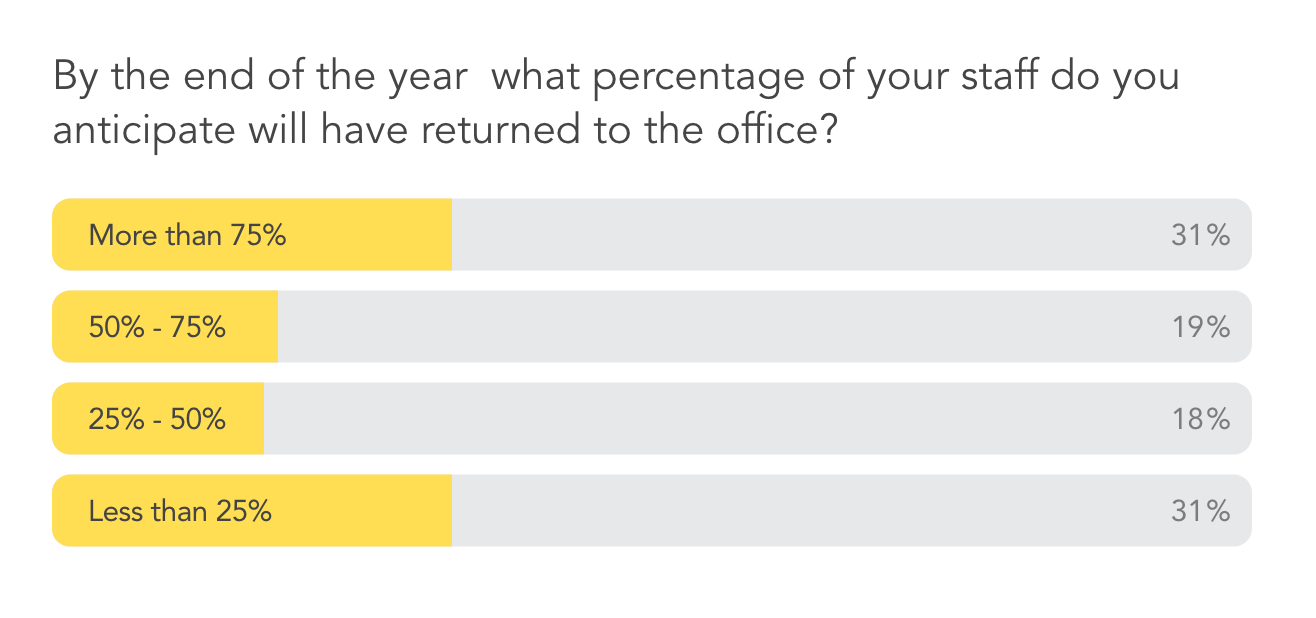

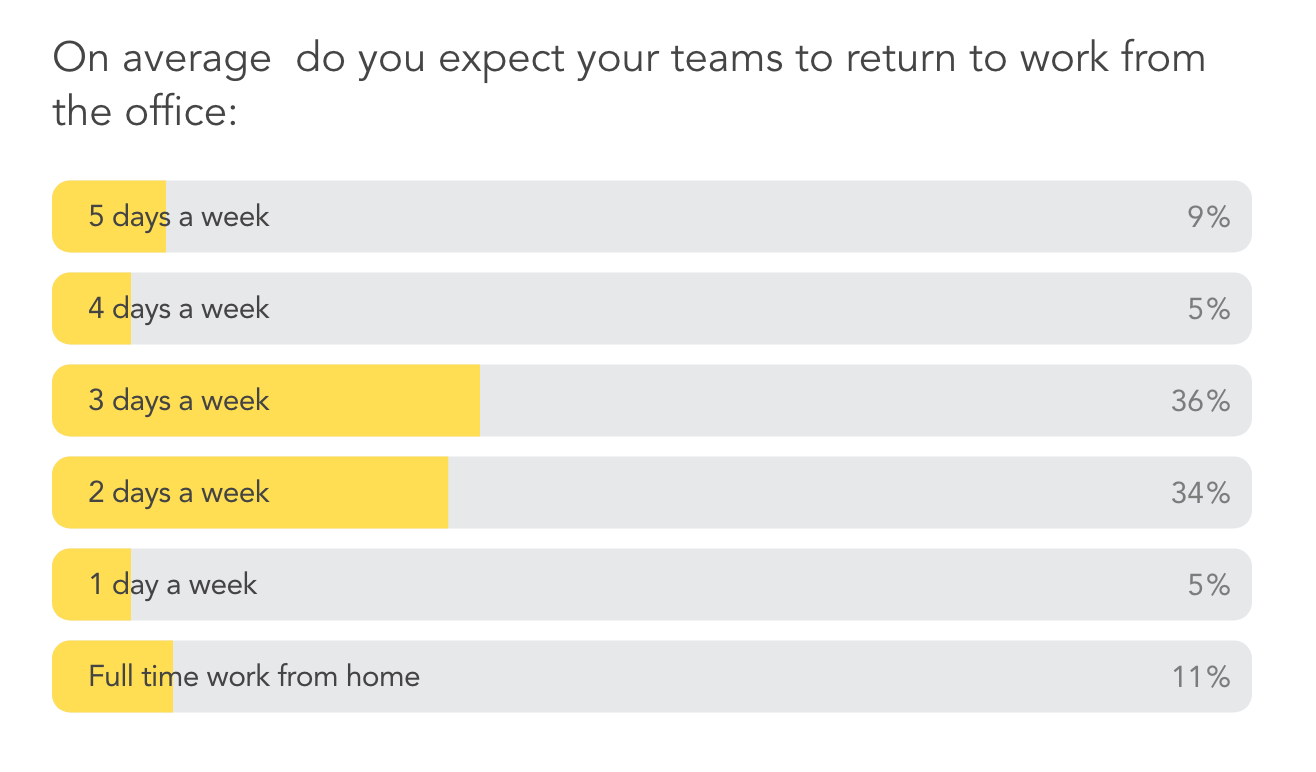

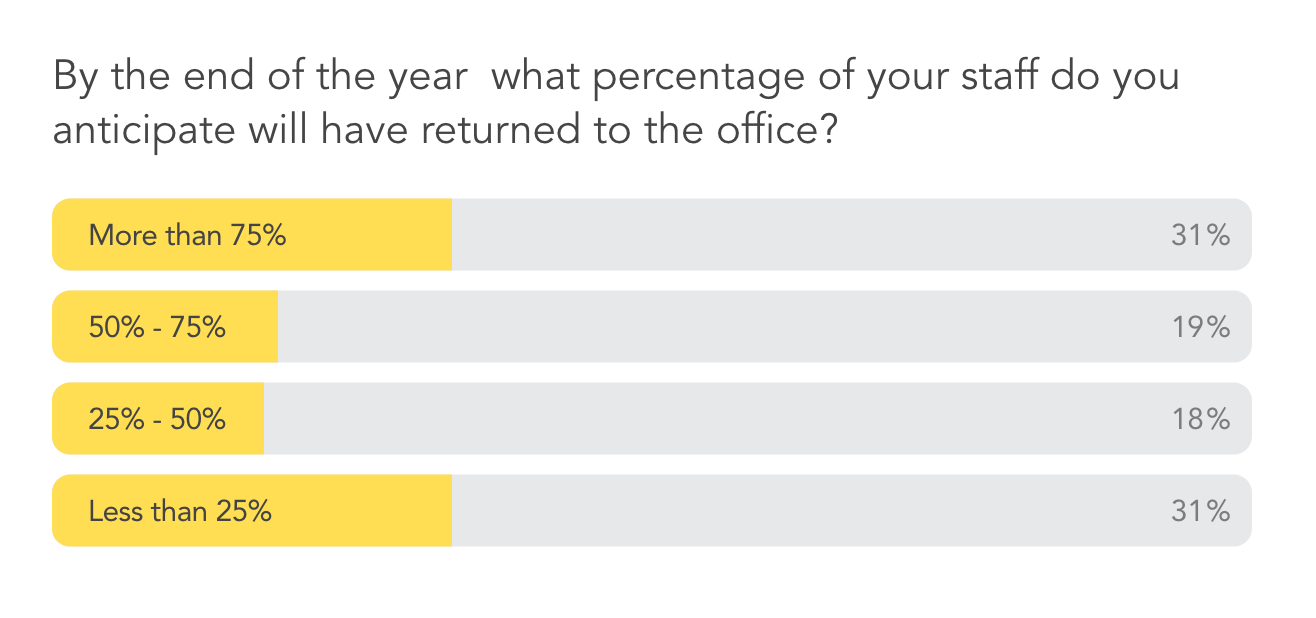

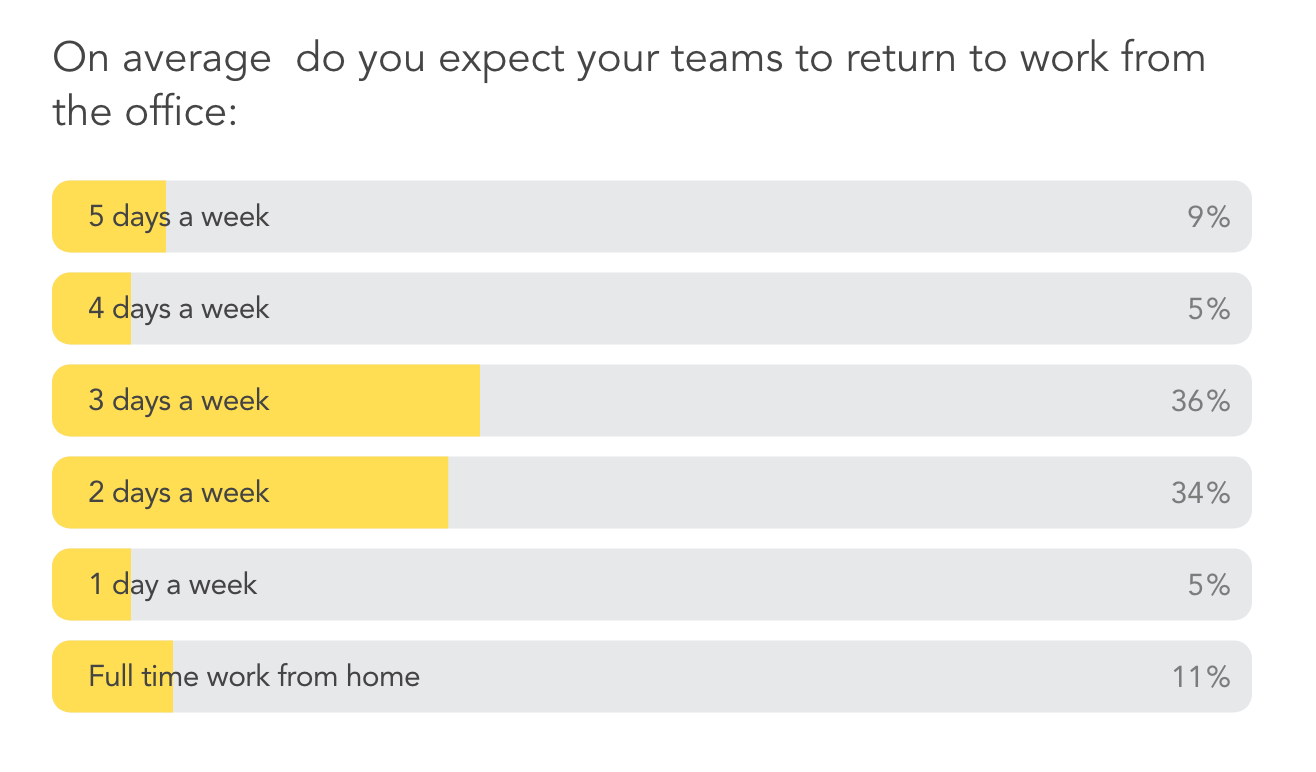

Of course, challenges persist, most notably when it comes to managing the many talent and return to work issues that have been amplified by the Covid-19 pandemic. Notably, respondents are evenly divided on return to office prospects this year.

More than two-thirds of respondents expect two to three days a week in the office, but one in 10 foresee a fully remote future.

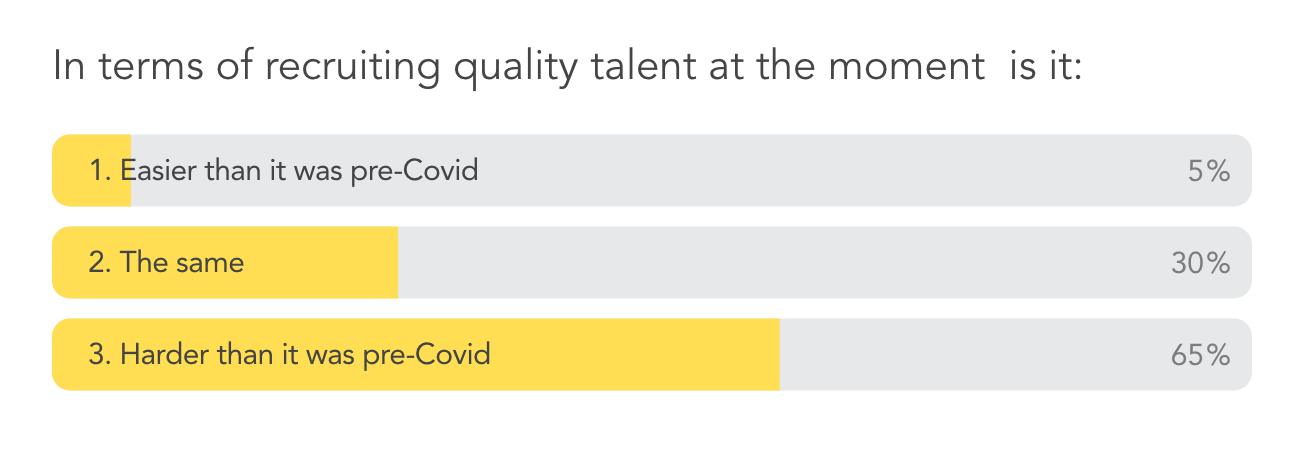

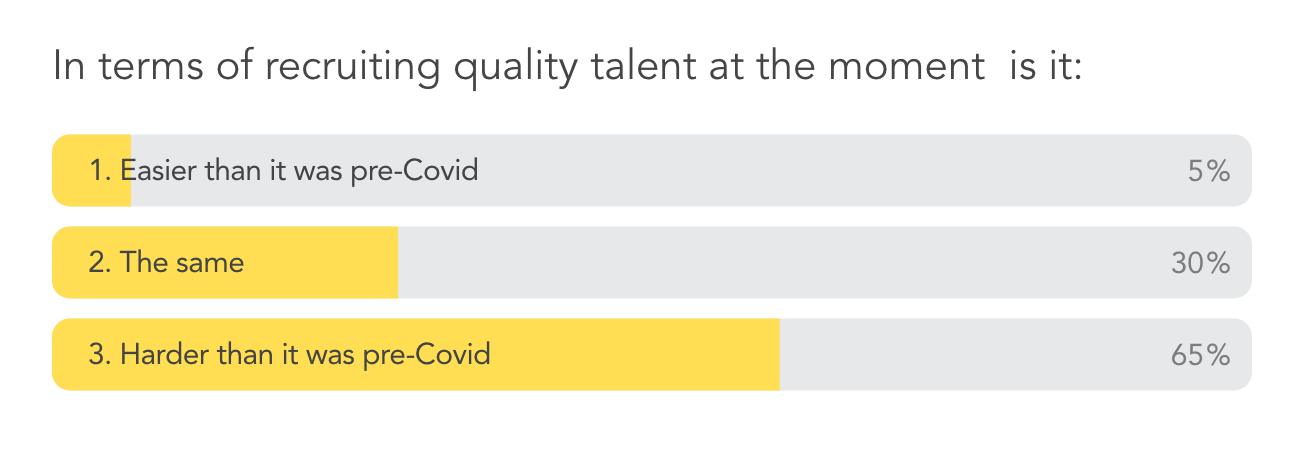

Meanwhile, respondents point to specific challenges when it comes to talent recruitment/retention and salary inflation.

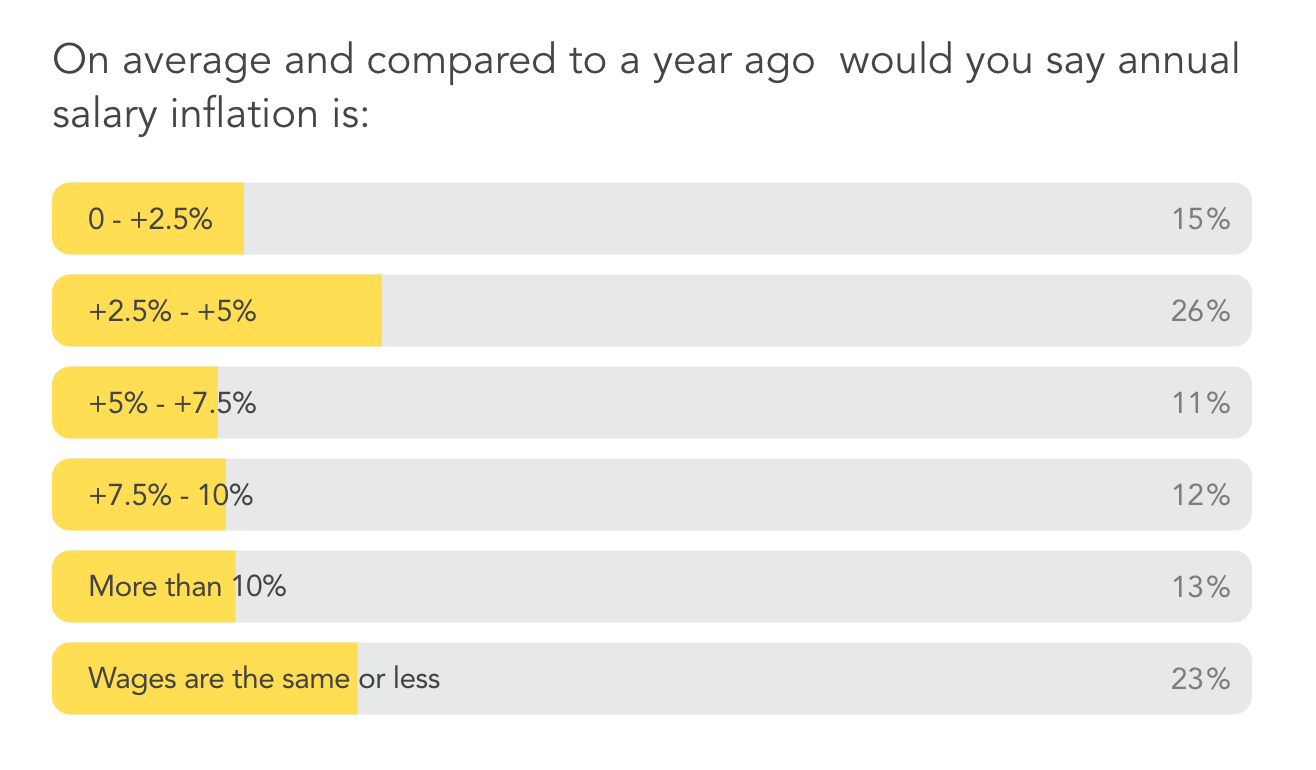

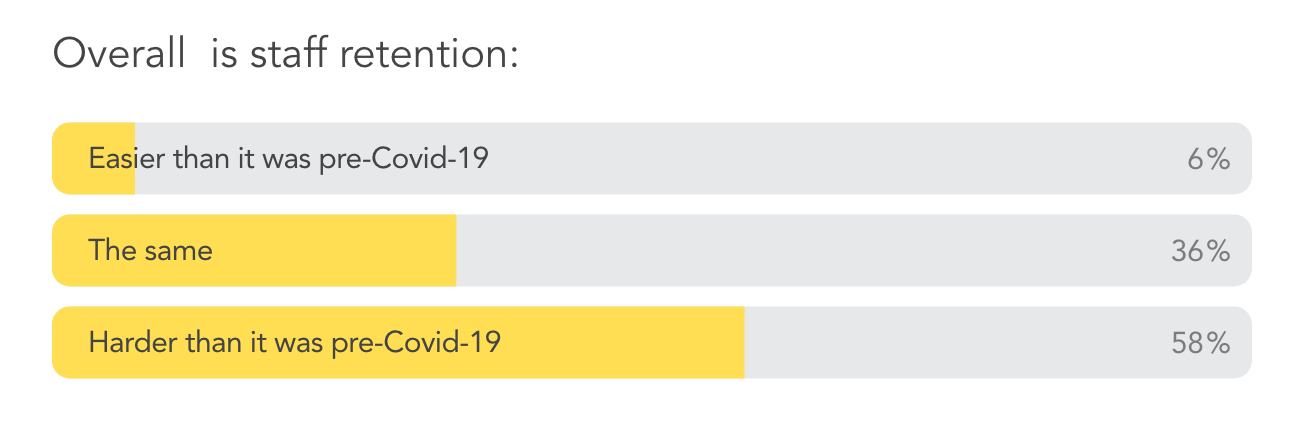

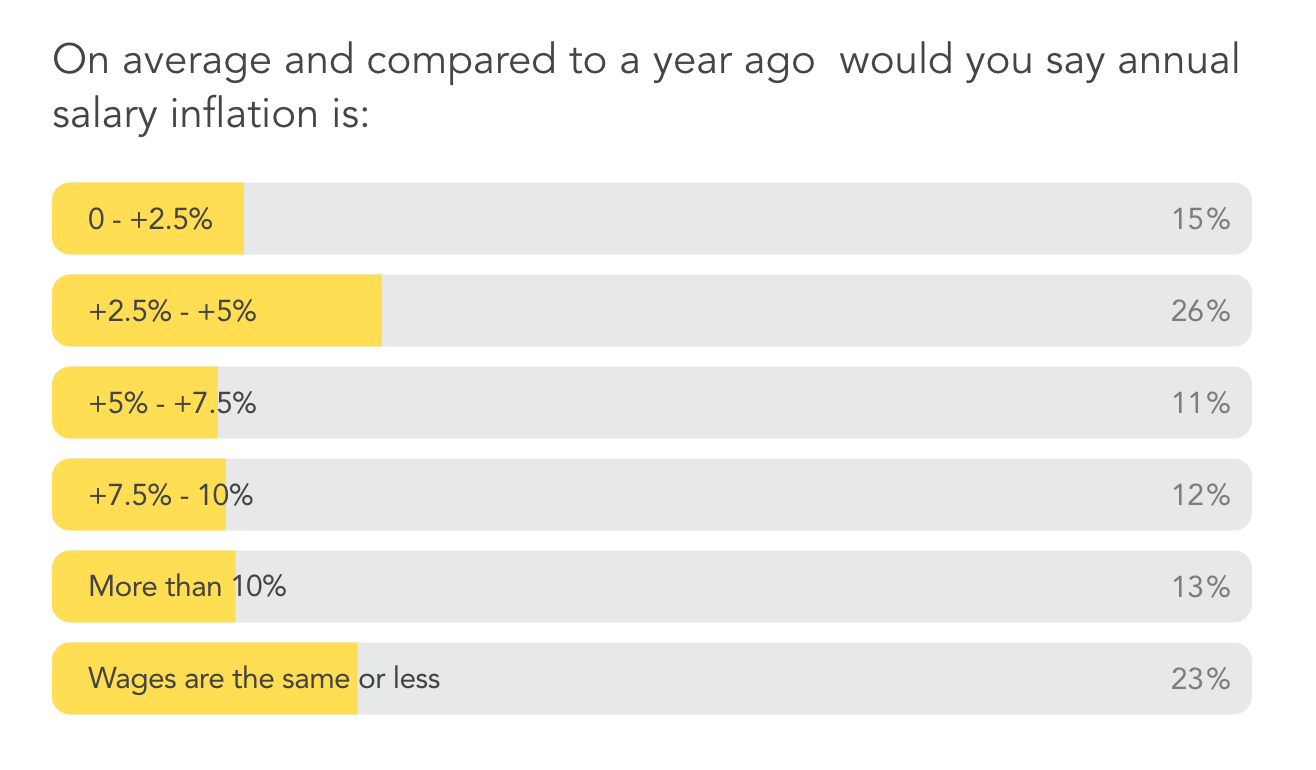

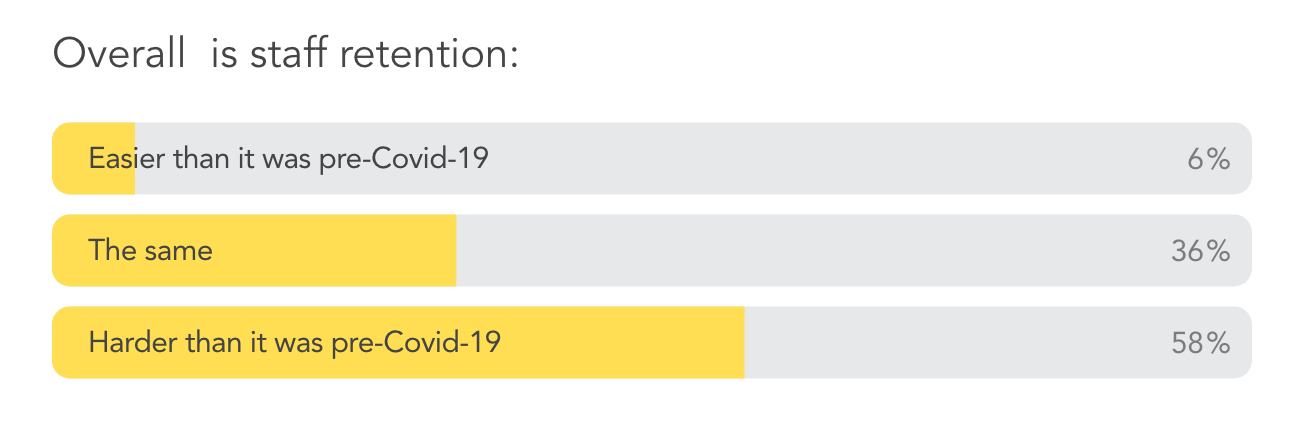

"Notably agency leaders are expecting to keep some sort of cap on salary costs. Whilst 36% expect salary inflation to be at over 5%, this lags their expectations on revenue growth, meaning that agencies expect to be making more profits this year," explained Brain. "Agencies always struggle to protect bottom lines when revenues decline like we saw during the crisis, so perhaps this is an industry wide rebuilding of balance sheets, but given that 58% are saying that staff retention is getting harder, this will be a tough balance to strike."

The study, which attracted 156 respondents from across the globe, also found remarkable positivity about the pandemic's impact on the business outlook, following on from the strong industry recovery predicted in the preceding wave of research in April.

45% of respondents describe Covid-19 as 'good for the PR industry', compared to 28% who see a negative impact. And that positivity no doubt stems from the business outlook.

Almost two-thirds of respondents (62%) report a positive revenue impact compared to the previous 12 months, with four in 10 revealing double-digit expansion.

72% of the industry expect a strong post-pandemic recovery, compared to just 4% who are bearish. That represents a significant improvement on the optimism that had already taken root six months ago.

"Remarkably, 45% of the PR agency leaders think the pandemic has been good for the industry," said Stickybeak co-founder David Brain. "Perhaps this is some form of Stockholm syndrome, but possibly it is due to the elevation of the discipline during crisis times when PR gets a seat at the top table.

"Hopefully this incredible confidence means that more agency and in-house leaders have hung on to that position even after the worst of the pandemic has passed," added Brain. "It would be good news if Covid has hard-wired more of the industry’s leaders into boardrooms and CEO offices."

The findings provide further confirmation of how the pandemic has reinvigorated demand for such services as corporate communications, crisis counsel and employee engagement, and underpinned sectoral growth in healthcare, B2B and technology. In addition, it appears that a consumer marketing rebound is underway.

Workplace & talent challenges

Of course, challenges persist, most notably when it comes to managing the many talent and return to work issues that have been amplified by the Covid-19 pandemic. Notably, respondents are evenly divided on return to office prospects this year.

More than two-thirds of respondents expect two to three days a week in the office, but one in 10 foresee a fully remote future.

Meanwhile, respondents point to specific challenges when it comes to talent recruitment/retention and salary inflation.

"Notably agency leaders are expecting to keep some sort of cap on salary costs. Whilst 36% expect salary inflation to be at over 5%, this lags their expectations on revenue growth, meaning that agencies expect to be making more profits this year," explained Brain. "Agencies always struggle to protect bottom lines when revenues decline like we saw during the crisis, so perhaps this is an industry wide rebuilding of balance sheets, but given that 58% are saying that staff retention is getting harder, this will be a tough balance to strike."

.jpg)