Holmes Report 15 Apr 2016 // 1:00AM GMT

Corporate communications executives around the world believe both they and their public relations agency partners will be expected to deliver more—more strategy, more content, more channels, more creativity and more measurement—over the next five years.

But questions remain over the industry's ability to attract the right talent, adapt to new technologies and increase the level of investment required to capitalize on these opportunities.

These are some of the headline findings from the first Global Communications Report, a comprehensive worldwide survey of more than 1,000 senior public relations executives, led by the USC Annenberg Center for Public Relations in conjunction with the Holmes Report. Over the coming weeks, the Holmes Report will analyse the findings in depth, covering everything from growth opportunities and challenges, talent, investment, media shifts, client-agency relationships, changing models and more. An executive summary of the findings is available here.

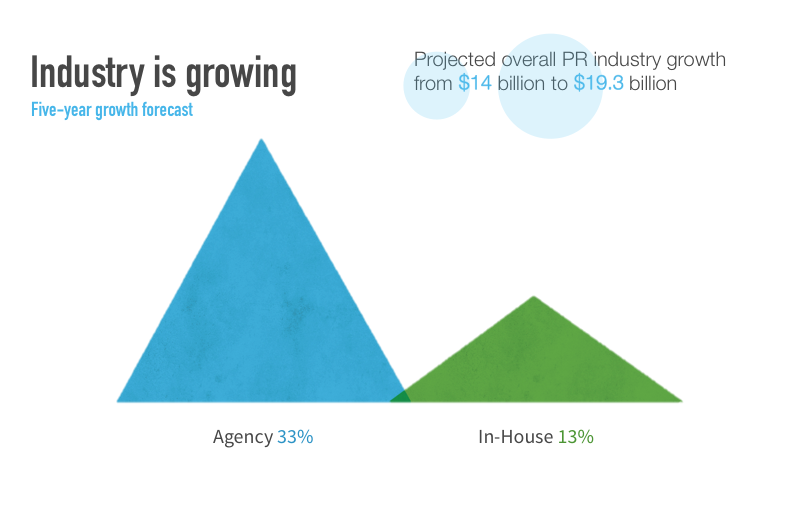

According to the study, PR agency leaders predict that the worldwide PR agency business will grow from its current estimated size of $14 billion to $19.3 billion over the next five years. To accommodate this growth, agency leaders anticipate their headcount will increase over the same period by about 26%.

By comparison, client-side budgets increased by an average of just 2.67% — and respondents expect budgets to increase even more slowly over the next five years, by just 13% by 2020 — about 2.5% annual compound growth. Client-side respondents expect an even smaller increase — 11% — in headcount over the next five years.

Growth & Challenges

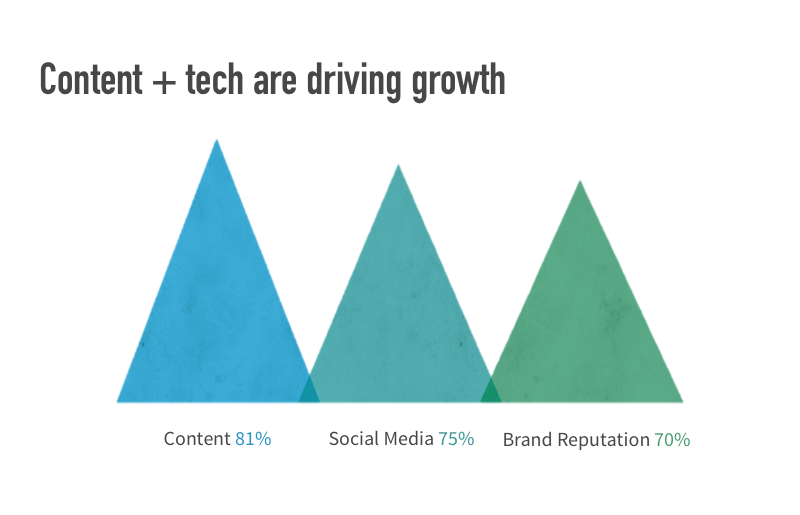

Industry leaders, both in agencies and in-house, believe future growth will be driven by content creation (81%) and social media (75%), as well as more traditional activities such as brand reputation (70%), followed by measurement and evaluation. Traditional media relations still ranks relatively high for both corporate and agency leaders (55%). However, advertising/paid media (18%) ranked last of 18 possible growth drivers.

“Overall, we are sensing a continued optimism about the direction the industry is headed, which is good news for people entering the field,” said Fred Cook, Director of the USC Center for Public Relations. “But questions remain about the industry’s ability to attract the right talent, adapt to new technologies and increase the level of investment required to capitalize on these opportunities.”

Both agency and corporate executives strongly agree that the ability to attract and retain the right talent is their greatest challenge and the majority of both groups believe the PR industry is not good at sourcing talent from outside its ranks, citing salary levels as the major obstacle.

Traditional expertise still tops the list of skills communications departments and PR firms view as key to success over the next five years. Written communications is the skill ranked most important by client and agency respondents. When asked what personal traits they felt were critical for the future, industry leaders ranked traditional values of teamwork and hard work near the top — but they also believe their teams are already strong in these areas. They say more horsepower is needed in curiosity, creativity and critical thinking.

When asked about diversity, only 45% of agency heads and 44% of corporate executives believe their ranks are as diverse as their clients’ customers or stakeholders. Both groups cite lack of access to diverse talent at senior and entry levels as the primary challenge.

“It’s clear that finding the right talent is by far the most critical factor in the PR industry’s future growth,” said Cook. “The more complicated question is what skills should this talent possess. Industry leaders still value traditional communications skills but are searching for more strategy, creativity and diversity.”

Changing models

Underpinning growth and shifting skillsets are are changing corporate and agency structures. The vast majority of client-side respondents (97%) anticipate some change in the structure of their departments to better address changes in the communications landscape over the next five years, but 17% expect only a slight change and 51% say the change will be ‘moderate.’ Only 26% anticipate ‘an extreme amount of change’ and just 4% expect to see ‘complete change.’

Agency respondents to the survey also expect some change (98%), but again a plurality (45%) believe the change will be ‘moderate,’ although on the agency side 47% are anticipating ‘an extreme’ or ‘complete amount of change’.

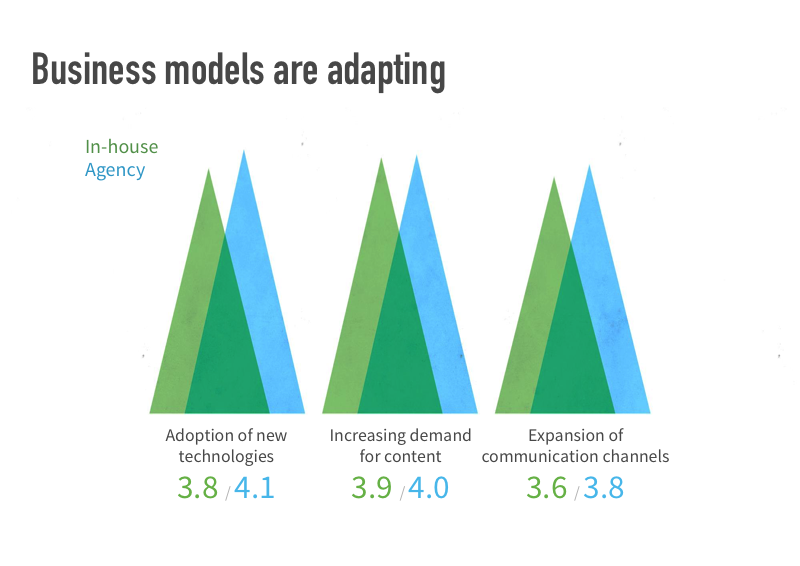

As for the drivers of change, agency leaders saw the adoption of new technologies (4.1 on a scale of one to five) as the biggest factor, followed by increased demand for content (4.0), the expansion of communications channels (3.8), increasing use of data and more demand for specialized services (3.5). Corporate leaders also ranked these areas as key drivers.

But while most commnications departments anticipate change, there’s no indication that budgets are changing to accommodate increased complexity and heightened expectations. As mentioned previously, client-side budgets increased by an average of just 2.67% last year and respondents expect budgets to increase even more slowly over the next five year, at around 2.5% per year.

Relationships also are shifting. Corporate communications clients acknowledge that they value agencies more for their strategy and creative prowess than for their “arms and legs.” Meanwhile, agencies disclose that about 30% of the time they report into marketing or brand management, versus 34% into corporate communications.

By 2020, agency leaders expect to see their revenue streams shift away from earned media, but it will still be the dominant revenue driver at 36%. Meanwhile, all of the other media categories will grow — owned to 24.6%, shared to 24.2% and paid to 12.9%. In total, PR executives predict 63% of all media outlets will offer paid placement opportunities in five years. Ironically, only 8% rank media buying skills as an important staff skill for the future.

“The pace of change in public relations has never been faster than it is today, but at the same time, it will likely never be this slow again,” added Paul Holmes, CEO of The Holmes Report. “Both agencies and their clients recognize that change is occurring, but it is not clear that they appreciate the extent, when it comes to finding non-traditional talent or developing non-traditional services, particularly outside of earned media channels."

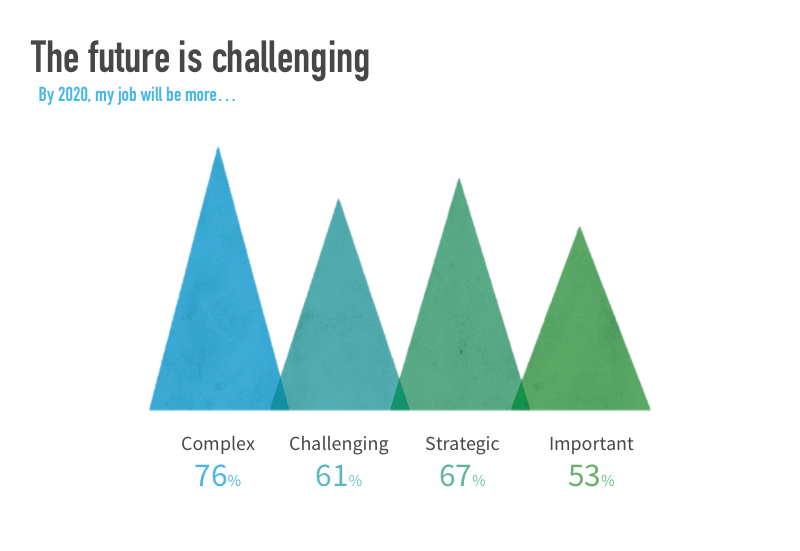

Looking to the future, it is clear that PR as a profession is evolving. All survey respondents agree that in five years their jobs will become more complex, challenging, and strategic. Only 27% of agency leaders believe by the year 2020 the term “public relations” will clearly and adequately describe the work they do.

Over the coming weeks, the Holmes Report will analyse all of these findings in depth at our Global Communications Report section, covering everything from growth opportunities and challenges, talent, investment, media shifts, client-agency relationships, changing models and more.

In addition to USC Annenberg’s Center for Public Relations and the Holmes Report, other Global Communications Report partners include the Institute for Public Relations, the Global Alliance for Public Relations & Communications, the International Association for Measurement and Evaluation of Communication, the PR Council, the Worldcom PR Group, Capstone Hill Search and PRSA.

.jpg)