Diana Marszalek 21 Sep 2018 // 6:28AM GMT

HONG KONG — A decade after the global financial crisis, the financial services industry has apparently rehabilitated its reputation in Asia, with a large majority of the population viewing the sector favorably, according to a new survey.

The study by MHP Communications and ORC International, formally called the 2018 Financial Services Reputation Index, found more than 80% of people in China and Hong Kong view the sector favorably, as do 90% of consumers in India and Singapore. In a similar UK study in February, just 53% of respondents said they viewed financial companies favorably.

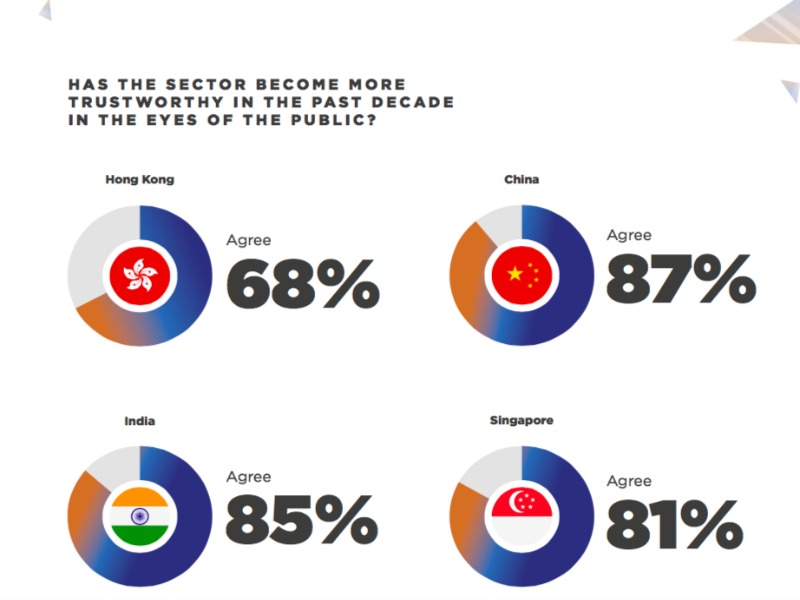

The survey also found 68% of respondents in Hong Kong and 87% in China believe the financial industry has become more trustworthy in the last 10 years, although they remain concerned most notably about data security and dishonesty.

Hong Kong residents ranked banking, payment systems and credit card companies the most trustworthy in the sector, while private equity firms were at the bottom of that list. HSBC, Bank of China, Hang Seng, AIA and Standard Chartered are Hong Kong’s most trusted financial brands.

In Hong Kong, 69% of respondents credited that spike in trustworthiness to increased consumer-protection regulation, 50% believe companies have become more transparent and 46% said that increased competition has improved practices. Yet that is not necessarily enough, with respondents calling for more transparency as well as better customer service and communications.

“Ten years on from the dark days of the global financial crisis, the findings of our inaugural Reputation Index for Asia show a dramatic turnaround in perceptions of the financial services sector,” said Emma Smith, MHP Communications Asia-Pacific CEO. “The crisis was not felt as acutely in Asia and the region was able to rebound quickly, spurred by the massive growth engine of China, strong macroeconomic fundamentals and favourable demographic drivers. Like their global peers, as reputation catapulted to the top of the CEO agenda, financial services companies in Asia have reassessed their purpose, their relationship with customers and their role in the community.”

Other study highlights include:

• 32% of people polled in mainland China and India stated that new and emerging digital financial services companies are more trustworthy than traditional companies, with the figure slumping to just 8% in Hong Kong.

• When choosing a financial services company in Hong Kong, the three most important criteria for respondents were organisations that operate responsibly (71%), the company is a good employer (68%) and it has a good CEO (60%). In mainland China, respondents cited companies operating responsibly as most important (90%), followed by companies that have a good CEO (80%).

• When asked to rank the most trustworthy professions in Hong Kong, 73% of respondents chose lawyers, over bankers (37%), journalists (36%) and the police (33%).

The study is the first of its kind from MHP Communications and ORC International. Results are based on a survey of 4,049 adults aged 18-55 in Hong Kong, China, Singapore and India. At least 1,000 people were from each of those markets.

.jpg)