Arun Sudhaman 31 Oct 2023 // 8:41AM GMT

ESG has become a critical driver for Asia-Pacific in-house communications professionals, according to the third edition of a landmark study that finds not only sustained confidence in the function's value within organisations, but also suggests that communications budgets are rising.

The 2023 Asia-Pacific Communications Index is conducted by the Asia-Pacific Association of Communication Directors (APACD) in conjunction with Ruder Finn Asia, and polled more than 100 senior in-house communications executives (including APACD members) across the region during the second and third quarters of this year. 63% of respondents identified as 'senior management' or higher, with the majority based in Singapore, India, Hong Kong or Australia.

“Communications professionals bring value to organisations navigating today’s big, major issues: an emerging multi-nodal geopolitical landscape; increasingly tangible impacts from climate change; disrupted supply chains; implications around artificial intelligence; and many more nuanced, complex risks,” said APACD president Keith Morrison. "While some APACD members have increased their team’s headcount last year, resources remain lean.”

“An industry resolution for 2023? Listen more to our internal decision makers, speak their language and adapt our function to meet their needs more specifically," concludes Morrison. "Or, you might say, do our own PR better.”

"In all our conversations with clients, three consultancy ‘value themes’ are always recurring," added Charles Lankester, Ruder Finn Asia EVP of global risk and reputation. "First, the ability to bring intelligence and outside thinking vs the in-house echo chamber. Second, the experience of senior counsel, especially when clients are triangulating challenging decision-making and need perspective. Finally, the ability to take on complex, time-intensive tasks to ease pressure in-house is seen as a competitive advantage."

ESG, investment & optimism

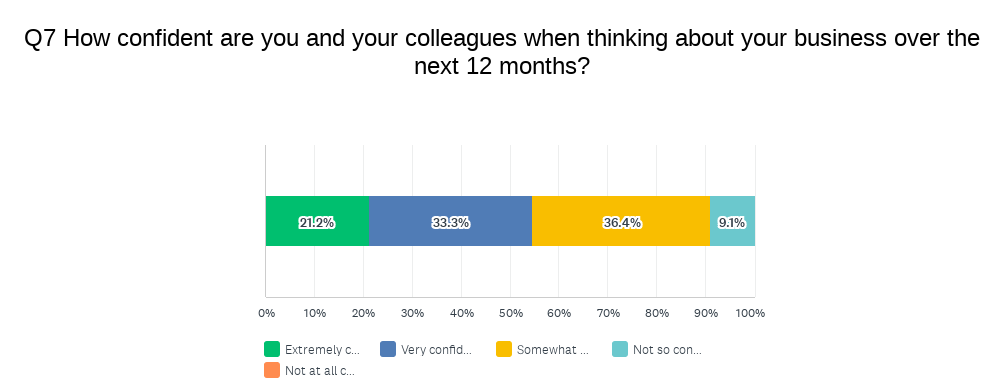

54% of respondents express high confidence levels about the next 12 months, almost exactly the same proportion as recorded in last year's survey. Almost seven in 10, meanwhile, describe the perceived value of their function as 'extremely valuable' or 'very valuable'.

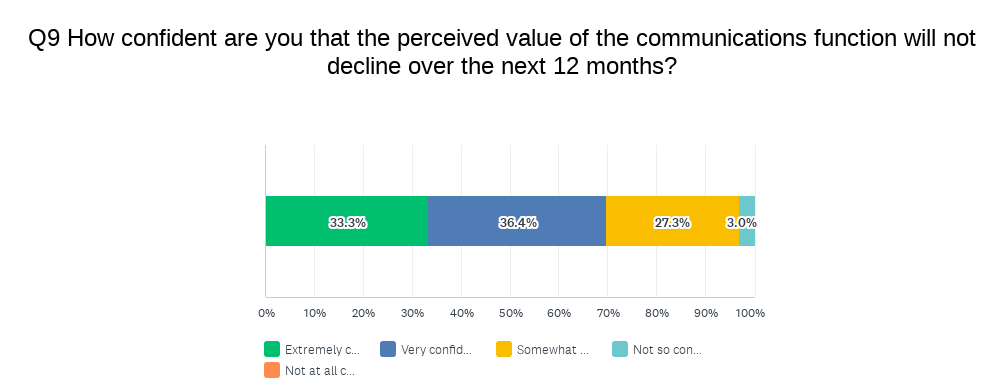

Crucially, around the same proportion do not expect this value to decline over the next 12 months, suggesting that the elevated role taken on by in-house functions during the Covid-19 pandemic is here to stay.

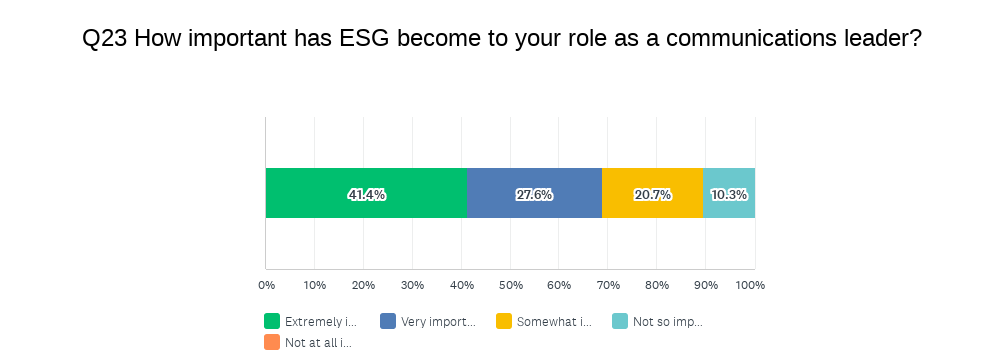

This year's study also attempts to uncover the drivers behind the continued optimism, particularly during a time of sustained economic uncertainty. ESG, perhaps unsurprisingly, emerges as critically important to today's in-house communications roles, cited by more than two-thirds of respondents.

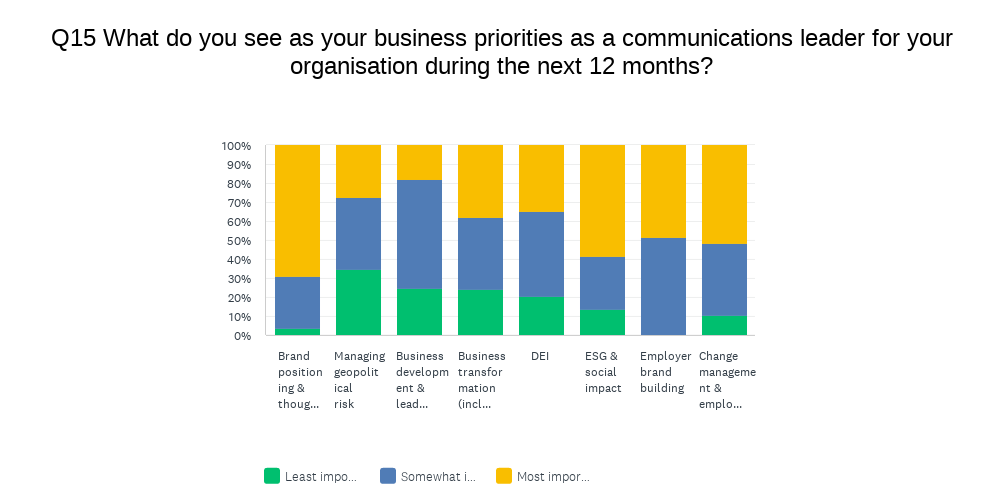

Furthermore, when it comes to the business priorities underpinning the positive sentiment, ESG ranks narrowly behind 'brand positioning and thought leadership', but ahead of 'employer branding', and 'change management and employee engagement'. 'Business transformation', which ranked first last year, drops to fifth position while 'geopolitical risk' is the least important priority for around a third of respondents.

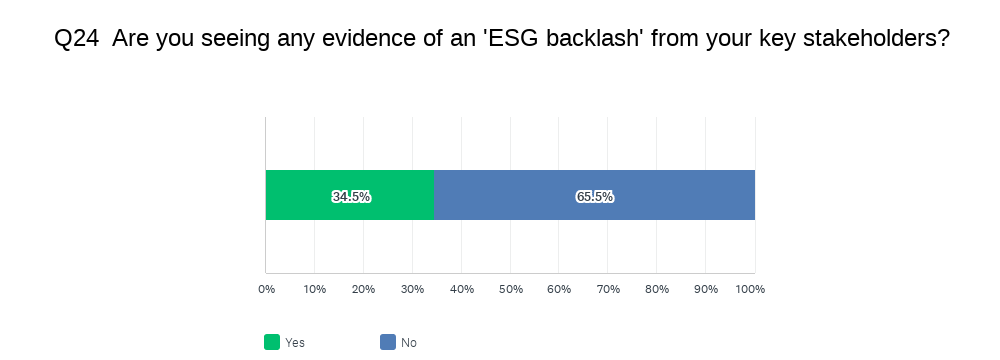

Unlike other regions, moreover, the ESG agenda in Asia-Pacific is not being unduly impacted by a backlash from key stakeholders. Only a third of respondents report evidence of this trend, compared to 66% who do not.

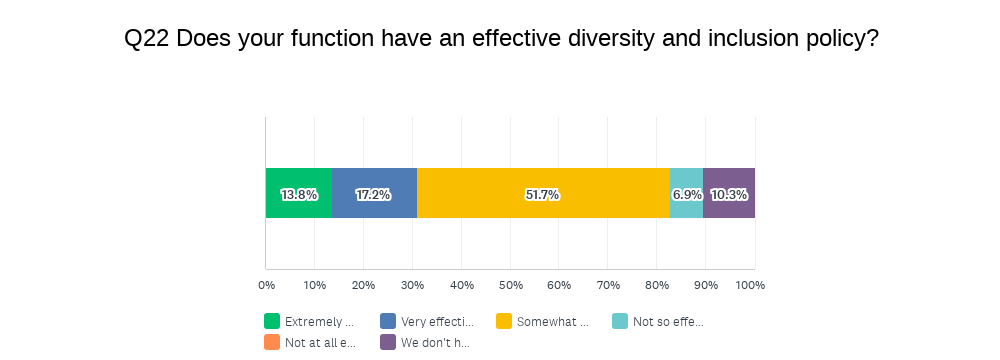

The rise of ESG, sadly, is not necessarily translating into more effective DEI policies in this part of the world. While almost two-thirds describe DEI as being important to their team, less than a third report effective DEI policies in their teams.

Expenditure & evaluation

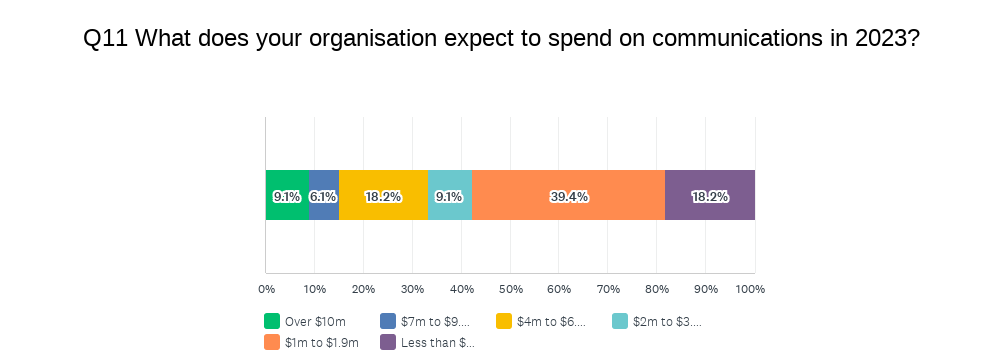

A consistent CommsIndex finding is that budgets and headcount have remained resolutely unwilling to rise. This year, however, finds some encouraging news in this regard, with 33% of respondents spending upwards of $4m on comms, compared to 29% last year. Those spending less than $1m drops to 18% from 27%.

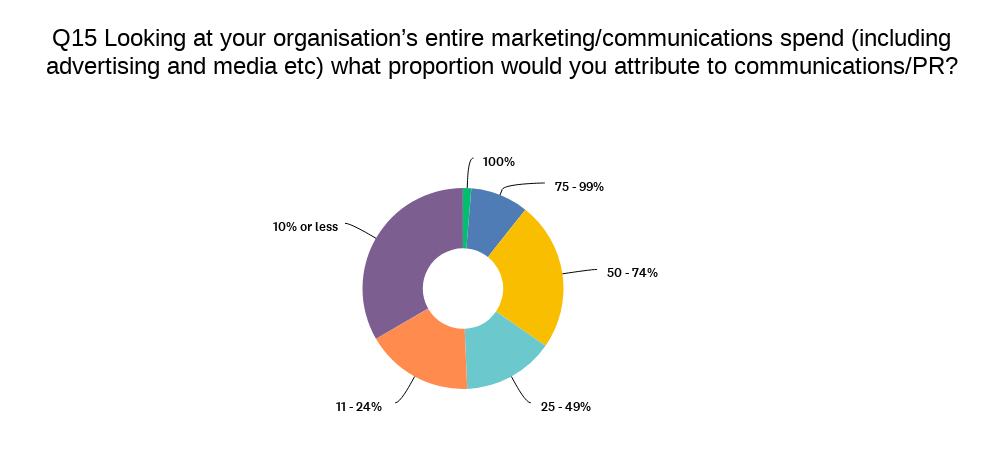

Almost four out of 10 (39%) respondents, furthermore, attribute more than half of their entire marketing communications budget to communications, a considerable increase on 2022. Just 21% peg this figure at 10% or less, compared to 33% in 2022.

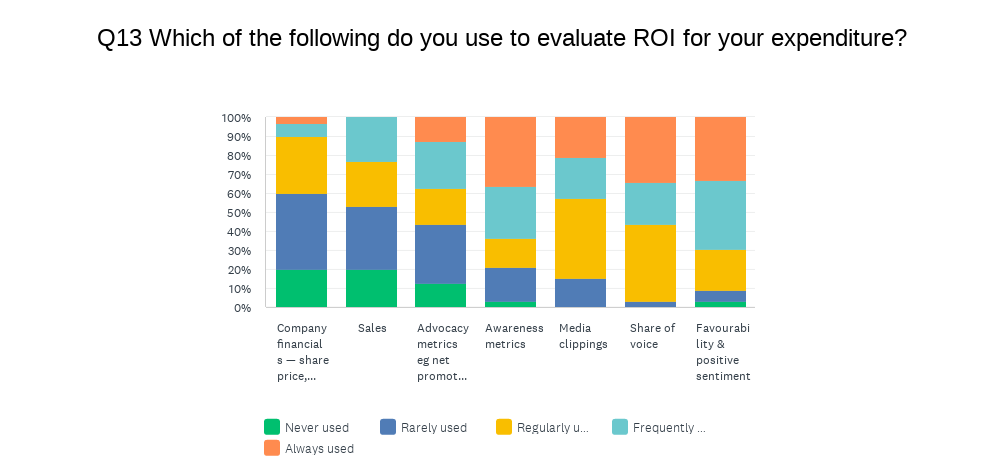

When it comes to the critical question of how this expenditure is evaluated, this year sees a modest improvement — in that favourability/sentiment scores now rank ahead of share of voice, media clippings and awareness metrics. But it remains telling that there is far less support for actual evidence of behavioural change and business outcomes, such as advocacy metrics, sales and company financials.

“As always, it’s down to our industry to effect change in terms of perceived value,” said Lankester. “We strive to focus more on intelligence, insights and thought leadership, helping clients show their own value. Our primary mission, tough as it sounds, is to make real connections and, where possible, change the behaviour of the groups who matter most to our clients. In 2024, clients should chart a simple mission for their external advisors: show value. Ask your consultancy to quantify the value they have created and will create for you. If a numerical value is not realistic, ask for clear, fluff-free evidence of what is better in your business as a result of your consultancy’s presence."

“Measurement – and how we communicate our impact – remains the Achilles heel of the function; this ultimately limits growth and investment," said Morrison. "While the data clearly shows optimism for the function, we have to learn from marketing on how it communicates its value to executives. Ask yourself, what really matters to your CFO and CEO? Then measure that and communicate that succinctly and impactfully.”

Staffing & responsibilities

After reporting an increase in staffing levels in 2022, more than 80% of in-house comms leaders say that headcount has remained static this year — which may well reflect the economic uncertainty that has plagued business performance this year. In-house communications teams remain relatively small in this region — with more than half (58%) numbering fewer than nine executives.

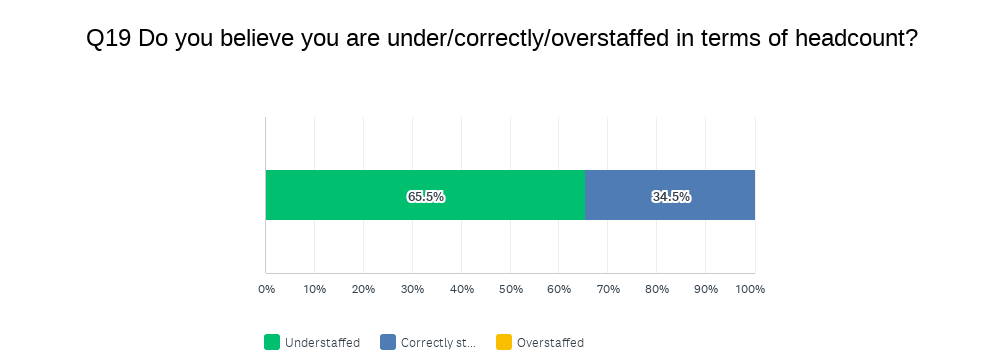

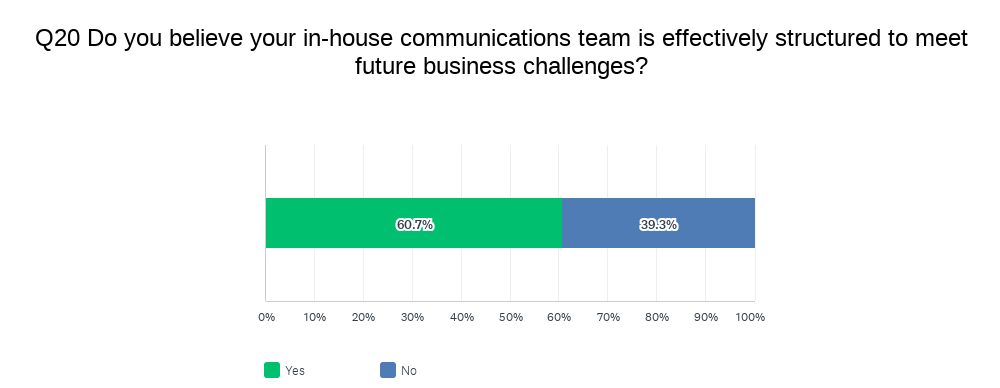

Once again, around two-thirds of in-house comms executives (66%) believe their function is understaffed, compared to one third who find headcount levels commensurate with the level of work required. Meanwhile, a relatively high proportion (four out of 10) believe that their function is not effectively structured to meet future business challenges.

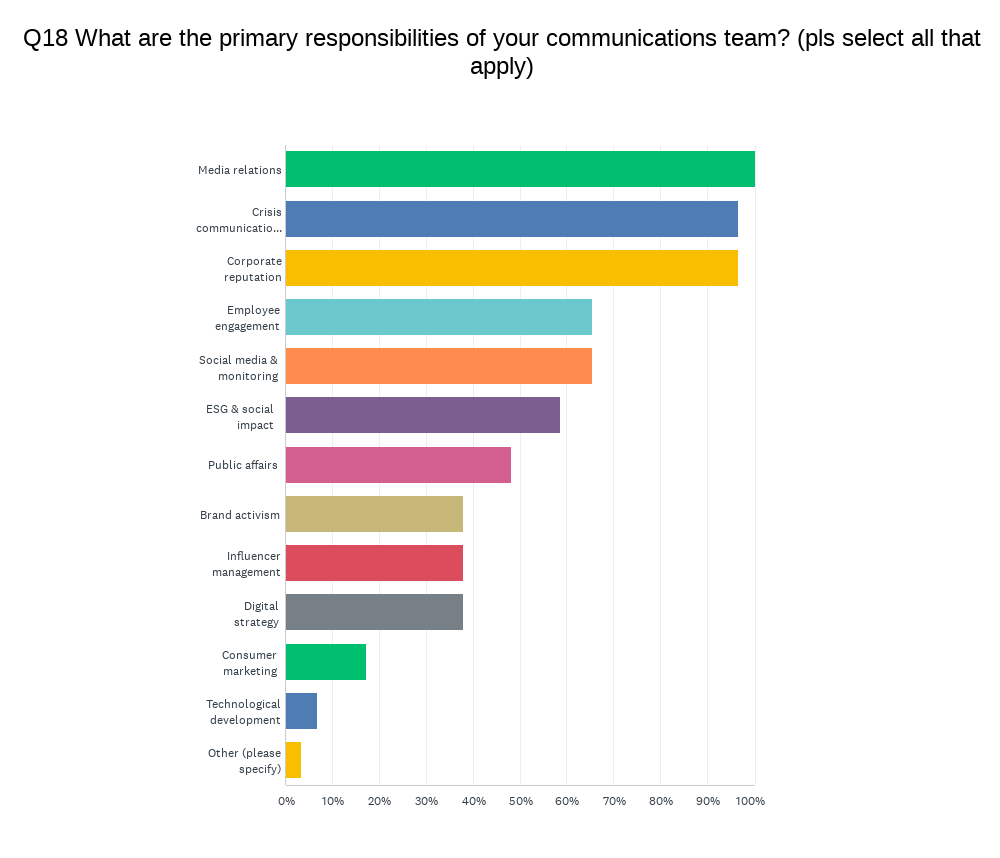

When it comes to the primary responsibilities of the communications team, meanwhile, media relations remains on top, selected by 100% of respondents, ahead of corporate reputation and crisis/issues (97% each), employee engagement and social media monitoring (66% each) — the same top five as the past two years. ESG and social impact is next with 58%, while public affairs jumps slightly to 48%.

Further results over the next week will reveal attitudes in trends related to the rise of AI, and the client-agency relationship.

Further results over the next week will reveal attitudes in trends related to the rise of AI, and the client-agency relationship.

.jpg)