Arun Sudhaman 28 Sep 2022 // 7:18AM GMT

Concerns about talent recruitment and rising costs have emerged as key threats facing the global PR industry, amid continued positivity regarding its growth prospects and perceived value. Those are just some of the headlines from the sixth wave of PRovoke Media's research tracker, which has been conducted with Stickybeak since the onset of the Covid-19 pandemic in early 2020.

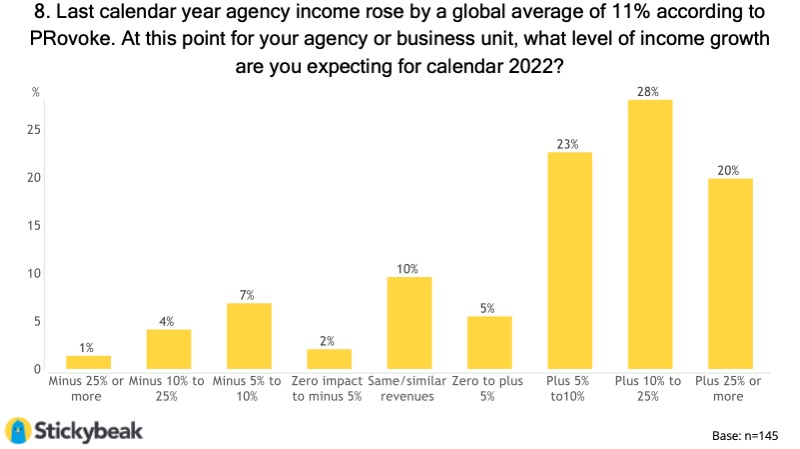

The study, which attracted 200 respondents from across the globe, predicts another strong year for the PR agency industry in 2022, following 11% growth in 2021.

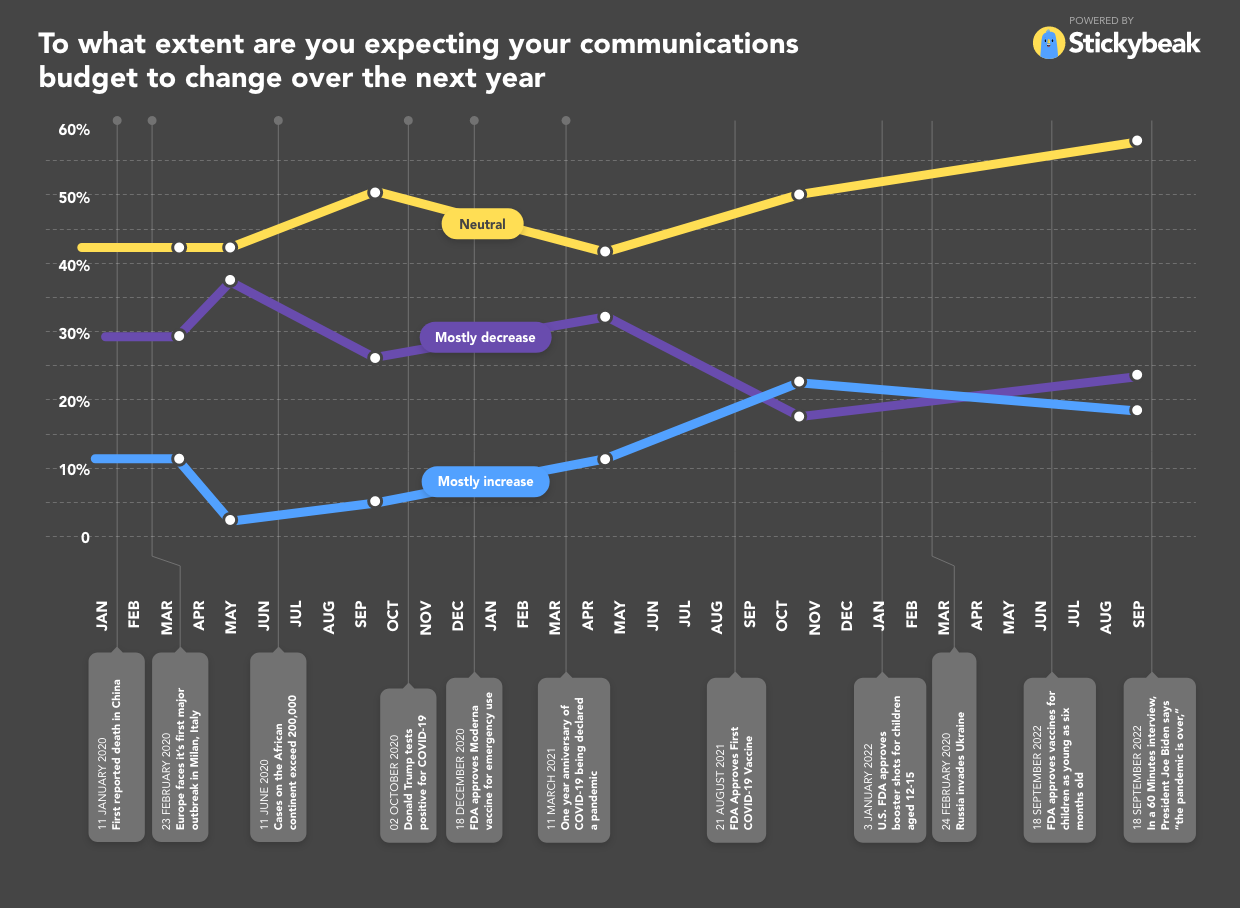

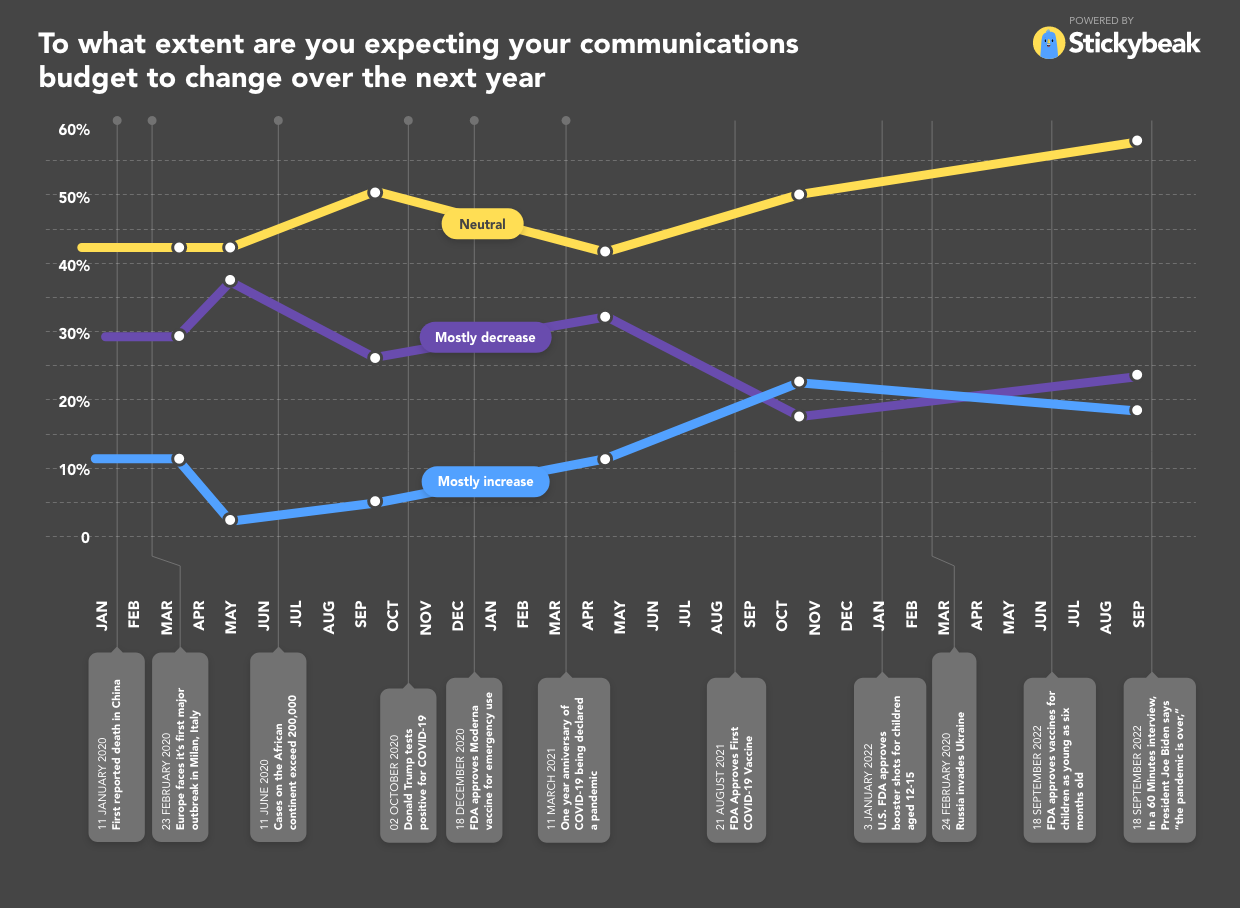

More than three-quarters of agency respondents expect double-digit expansion this year, following on from considerable optimism in the preceding wave of research last year. However, clients are less bullish, even if most expect budgets to remain neutral.

While more clients expected to increase their communications budgets one year ago, that proportion has again dipped below those who plan to decrease spend over the next 12 months.

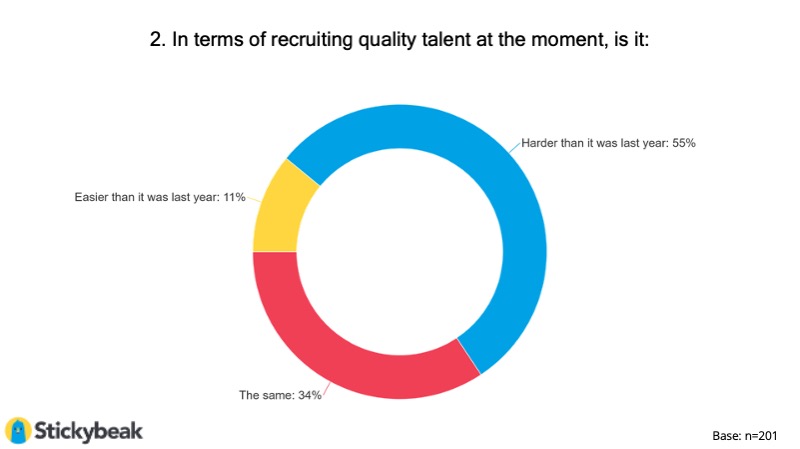

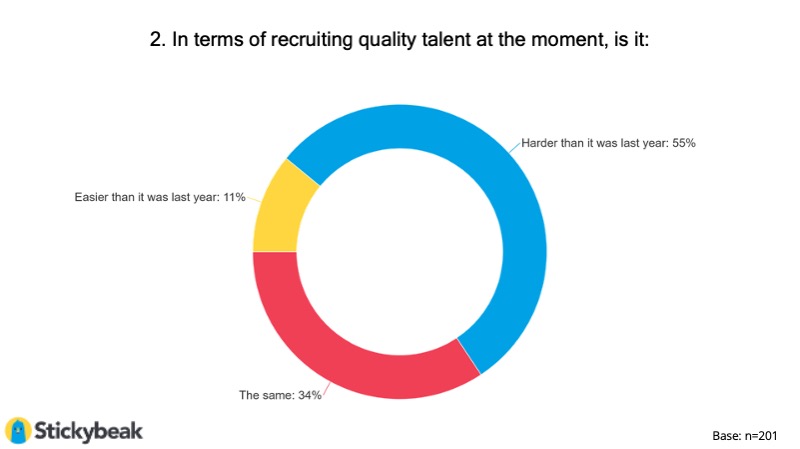

That may be down to some of the specific challenges raised by respondents. Chief among these is recruitment, across both agency and in-house.

55% of respondents are finding recruitment harder than last year, while 45% say the same of retention. Meanwhile, salary inflation has emerged as a particular challenge.

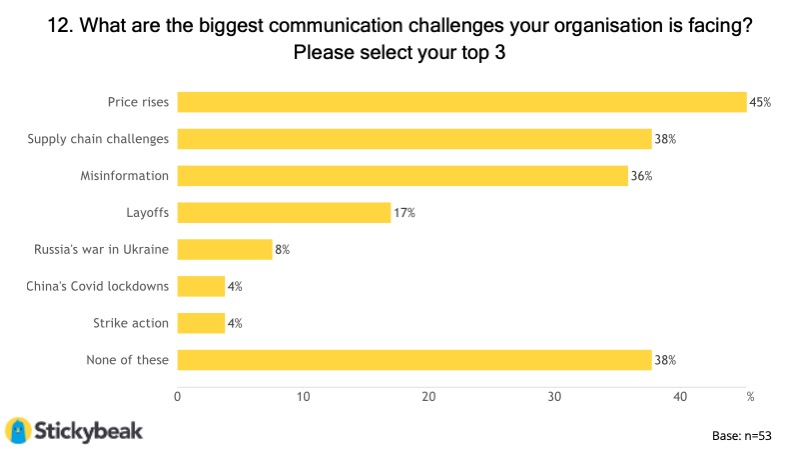

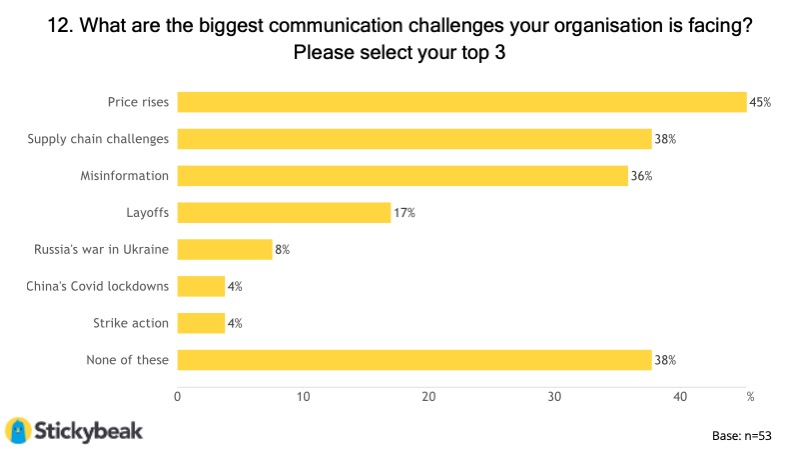

In addition, in-house respondents point to price rises as the biggest communications challenge they are currently facing, for the first time since the pandemic began more than two years ago.

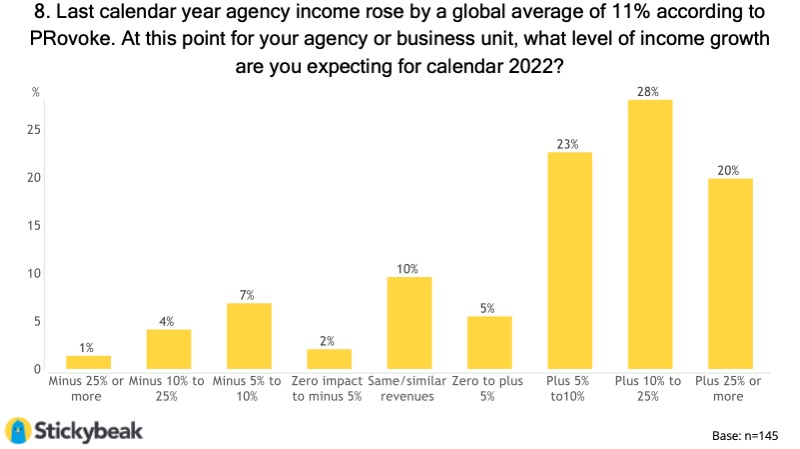

"Agency bosses have their work cut out this year balancing welcome higher revenues against higher staff costs and higher staff churn," said Stickybeak co-founder David Brain. "Just like national economies, agencies are in an inflationary cycle. The good news is that of the agency leaders we polled nearly half (48%) are projecting income increases of more than 10% with one in 5 saying they will bill an incredible 25% more. Overall, the industry looks to be heading to at least a repeat of last years 11% income increase which is incredibly encouraging."

"This is just as well, given salary pressures mean 14% of PR leaders say they will be paying their people over 10% more this year, but it does look like revenue rises are outpacing people costs which implies the industry continues to grow in real terms."

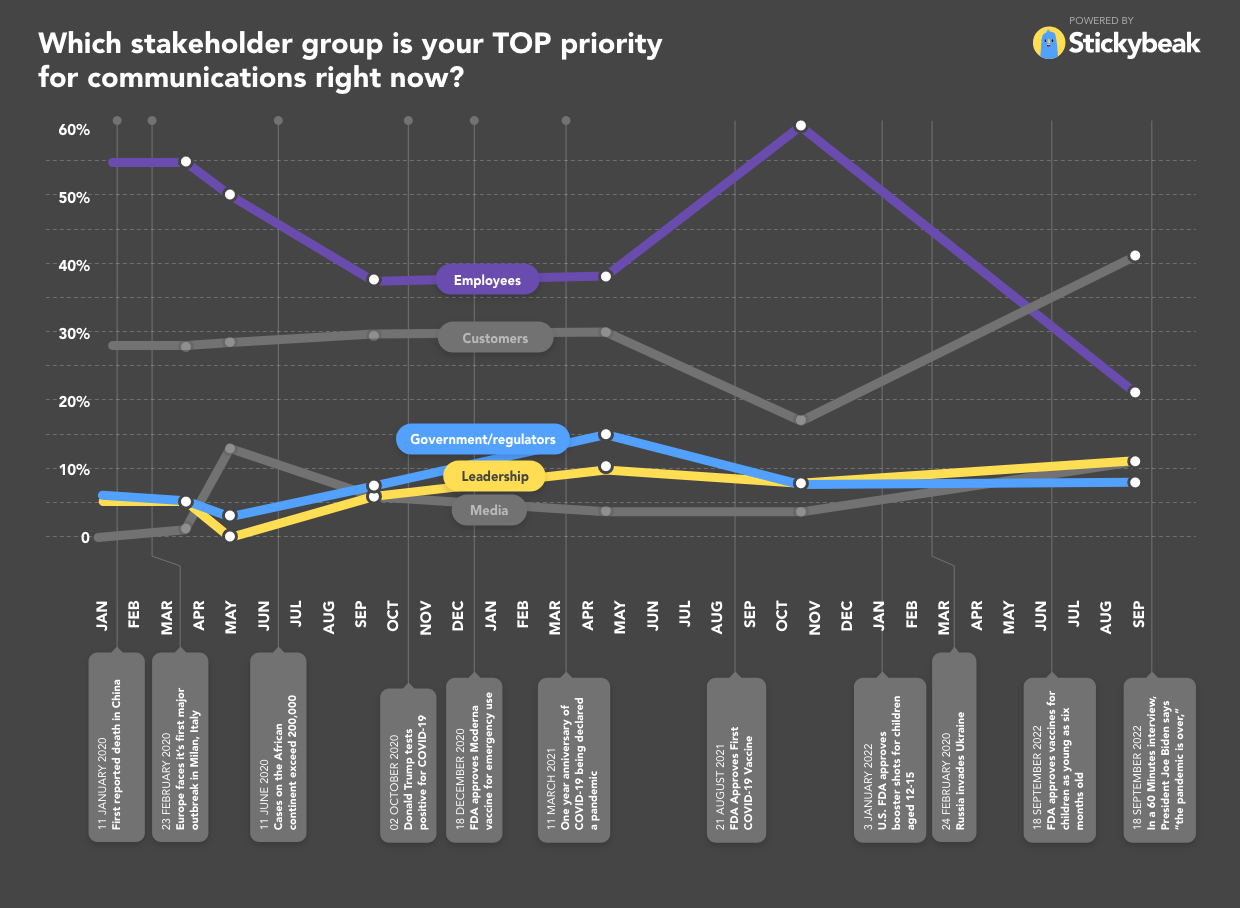

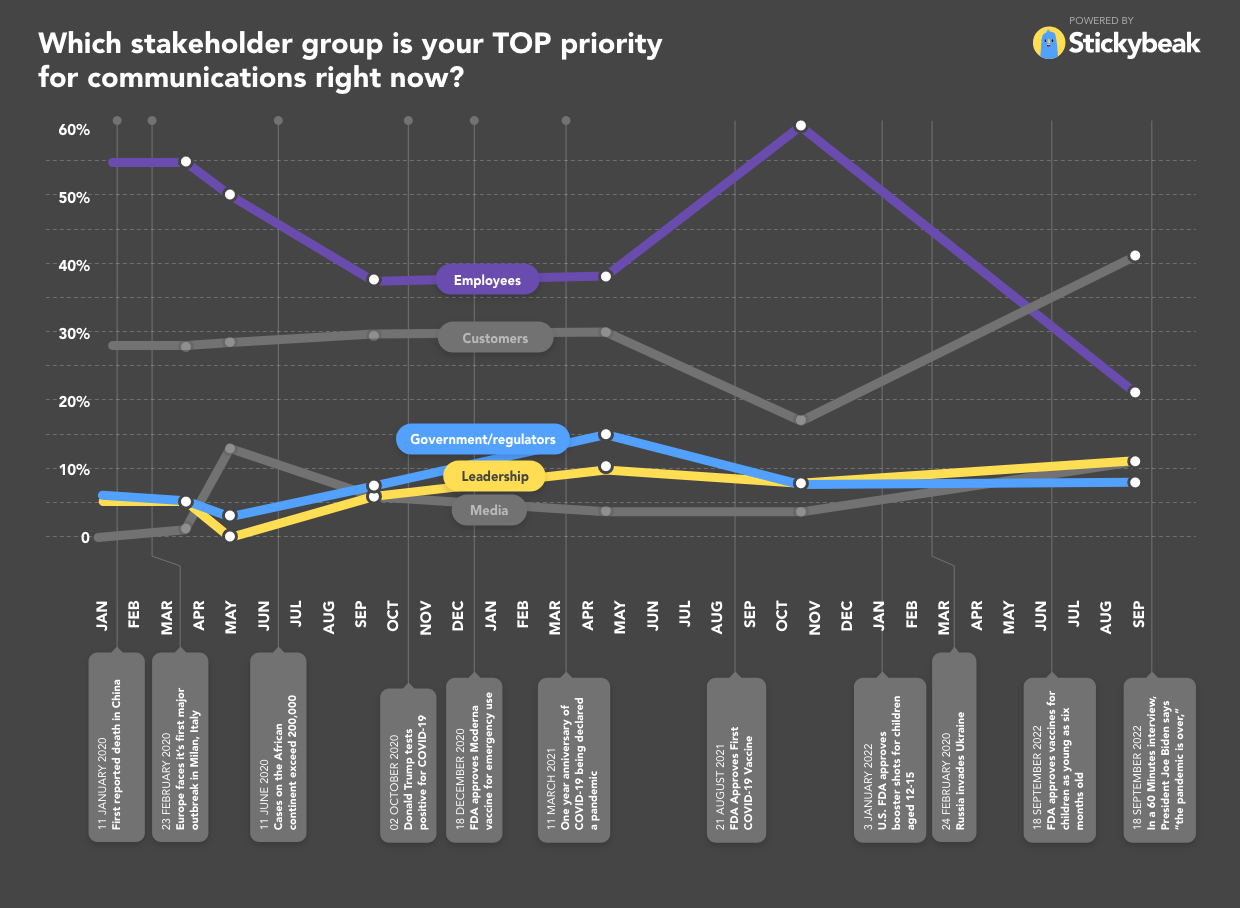

Price rises rank ahead of supply chain challenges and misinformation, with Russia's invasion of Ukraine posing little concern to in-house respondents. In addition, customers outrank employees as the most important stakeholder group for clients, another finding that is a first since the start of 2020, as the chart below demonstrates.

"The big change for in-house teams this year seems to be the focus on customer communications which has leapt as a priority," added Brain. "The reasons are clear given that price rises (45%) and supply chain challenges (38%) were cited as their biggest communications challenges. If the Covid years were the era of employee first communications, then we now appear to be in the era of customer first communications."

C-Suite & services

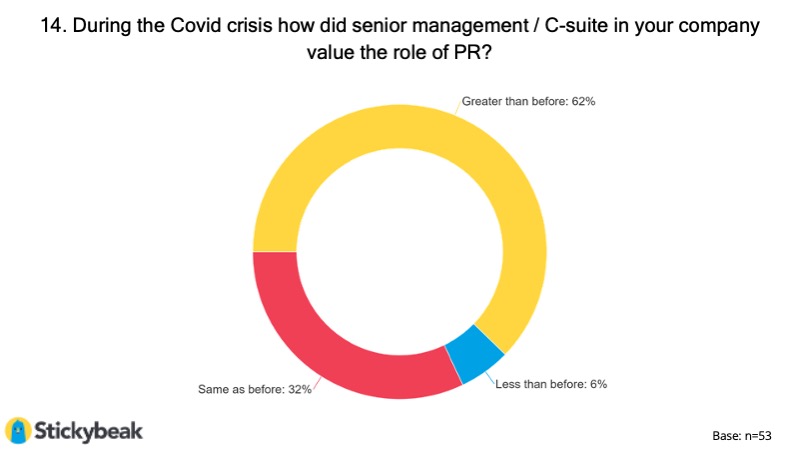

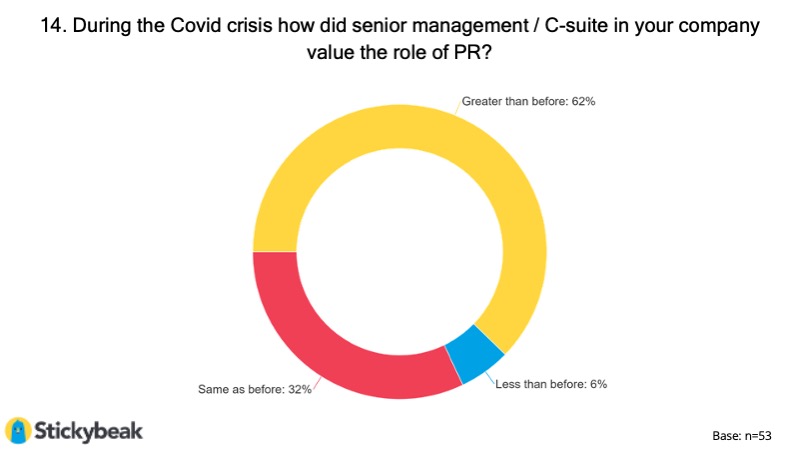

Almost two-thirds of in-house respondents agree that the Covid crisis has improved the value of public relations in the corporate C-suite.

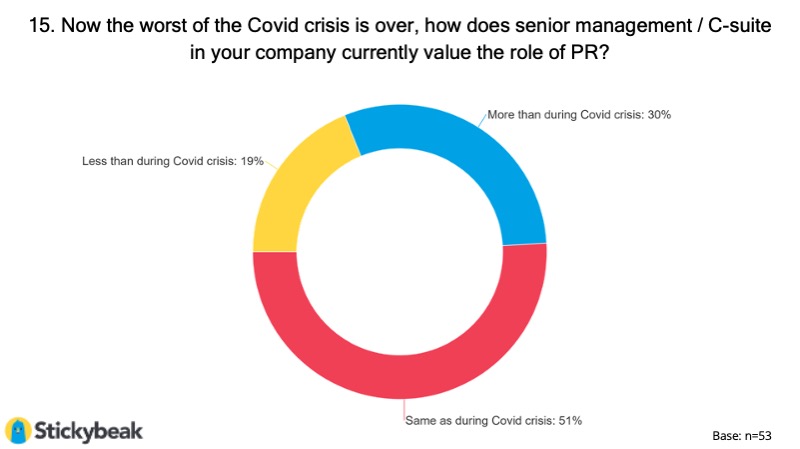

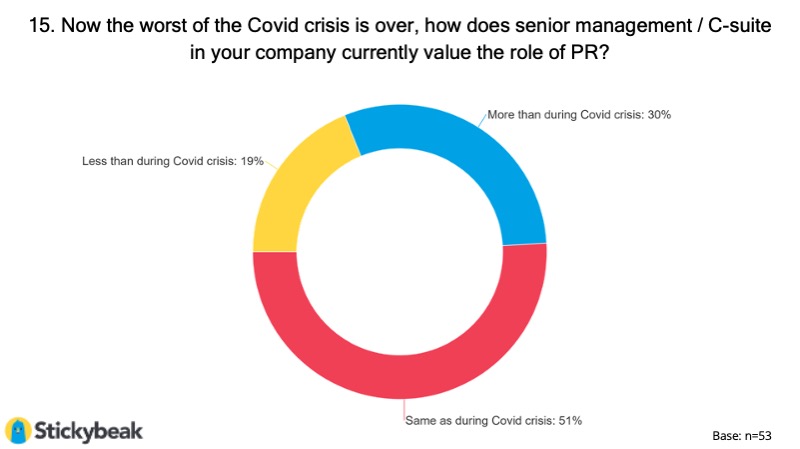

The benefits from this elevation in value may be here to stay, according to our respondents. Only 19% report that the value of the function has declined, now that the worst of the Covid crisis is over.

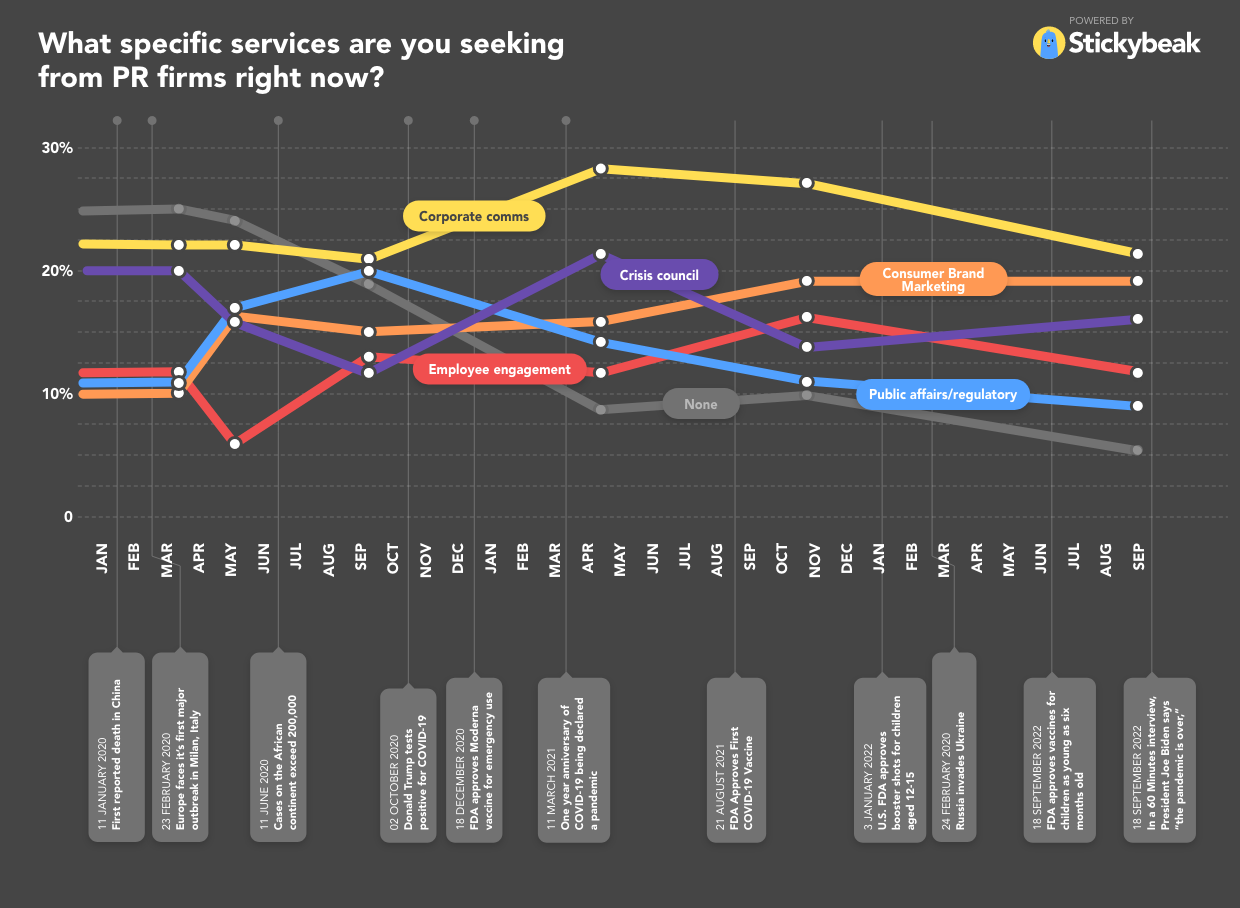

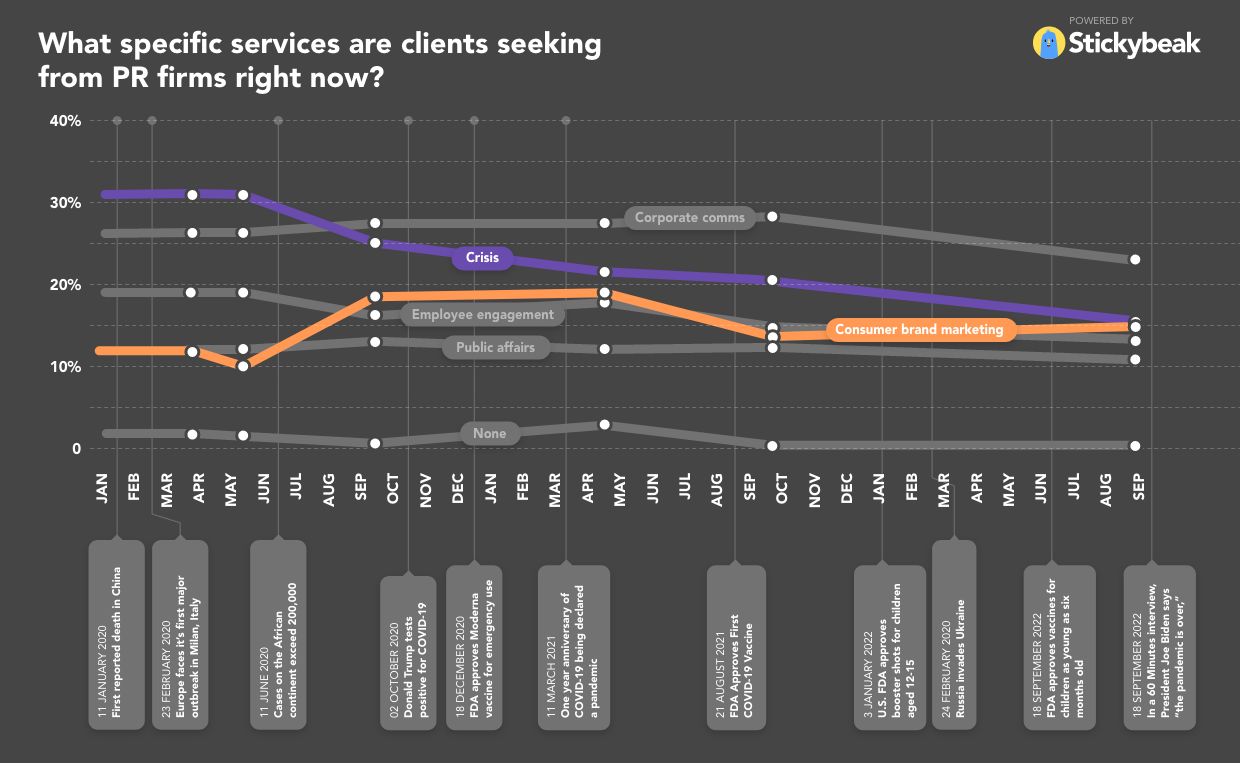

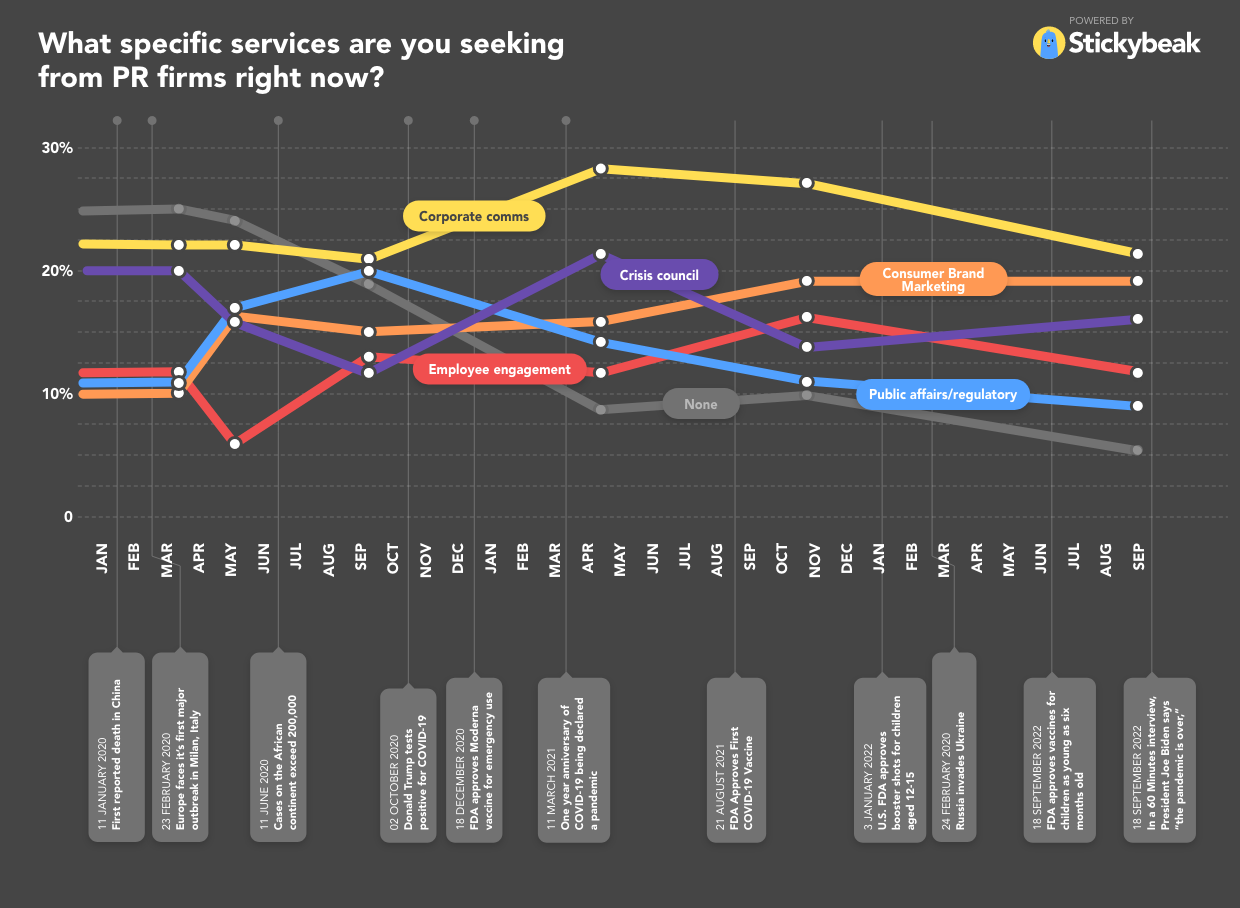

When it comes to specific services that clients are seeking from their PR firms, corporate comms remains on top, but there has been a strong rebound in consumer brand marketing.

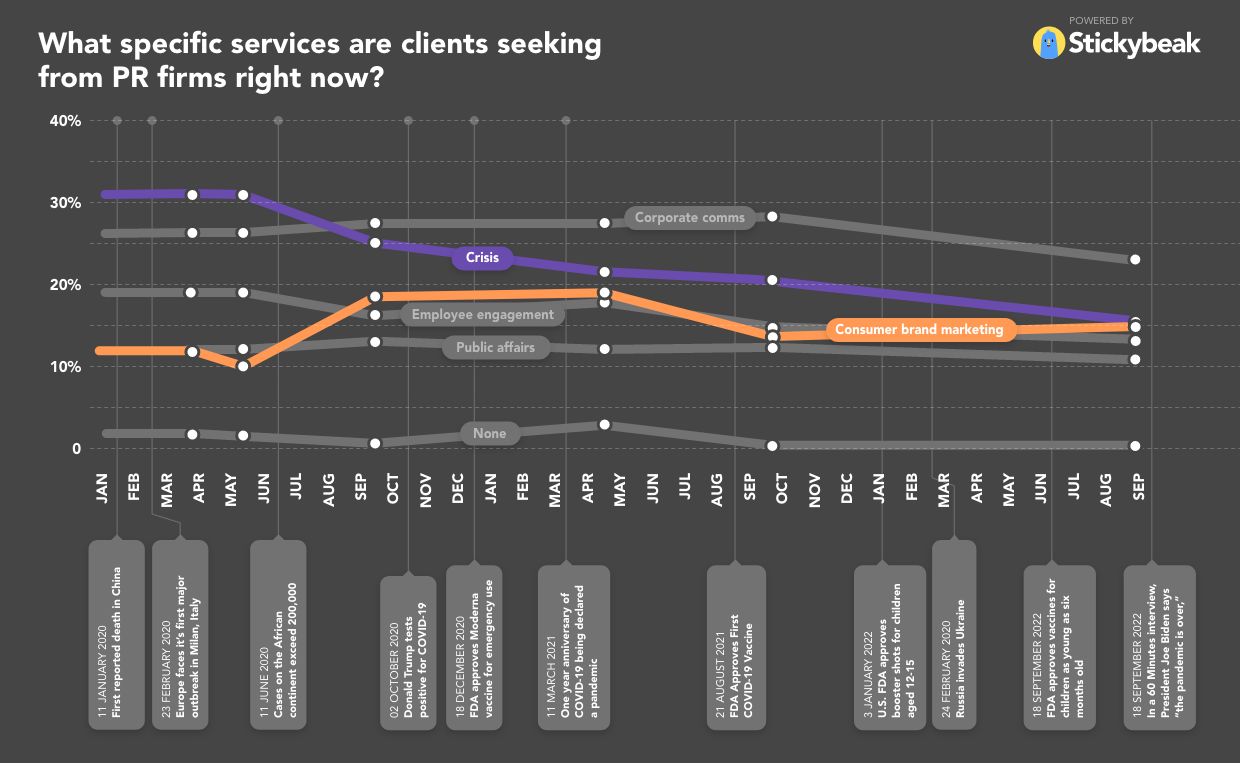

That much is borne out by agency responses too.

Work & travel

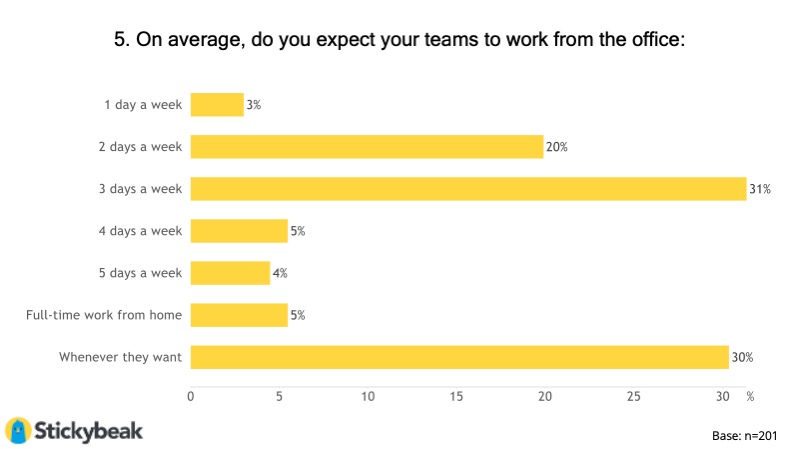

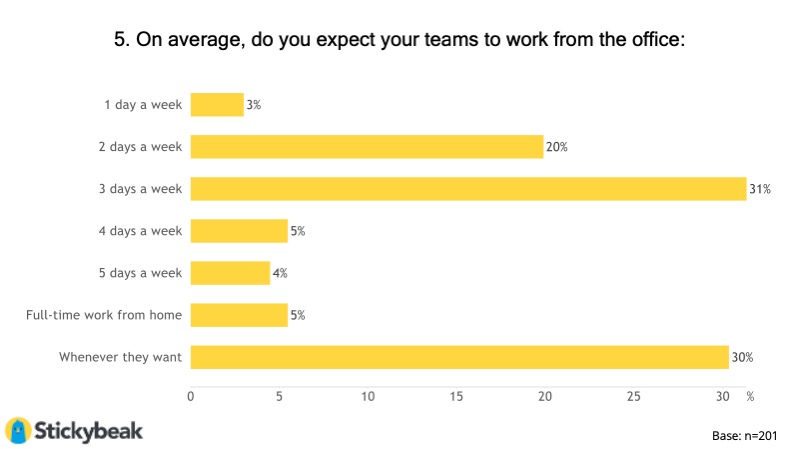

Reinforcing the results of our previous research, the hybrid working model is here to stay, with more than half of respondents expecting three days or less in the office, and 30% allowing complete flexibility.

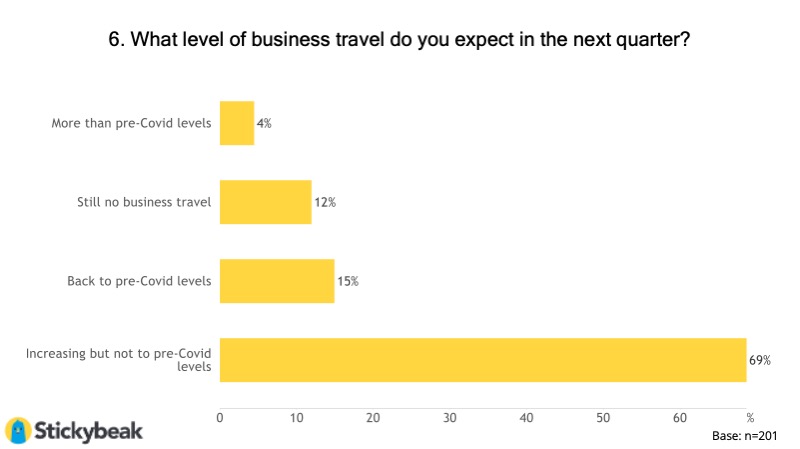

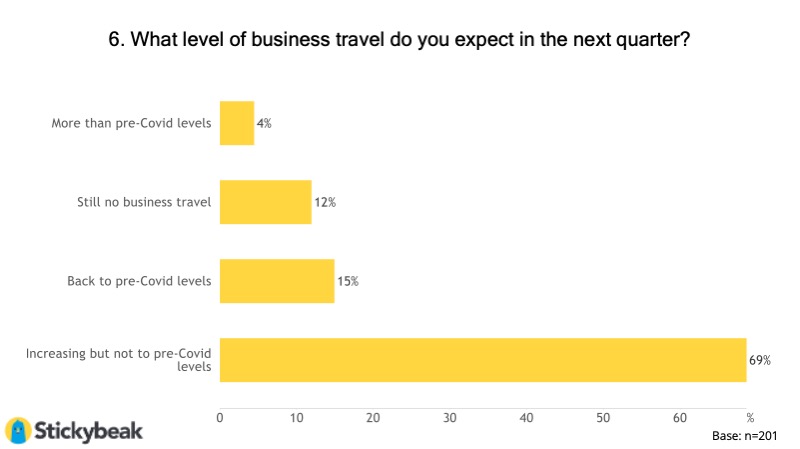

And it may well be that the nature of business travel has also changed. Only 15% report that travel is back to pre-Covid levels.

The study, which attracted 200 respondents from across the globe, predicts another strong year for the PR agency industry in 2022, following 11% growth in 2021.

More than three-quarters of agency respondents expect double-digit expansion this year, following on from considerable optimism in the preceding wave of research last year. However, clients are less bullish, even if most expect budgets to remain neutral.

While more clients expected to increase their communications budgets one year ago, that proportion has again dipped below those who plan to decrease spend over the next 12 months.

That may be down to some of the specific challenges raised by respondents. Chief among these is recruitment, across both agency and in-house.

55% of respondents are finding recruitment harder than last year, while 45% say the same of retention. Meanwhile, salary inflation has emerged as a particular challenge.

In addition, in-house respondents point to price rises as the biggest communications challenge they are currently facing, for the first time since the pandemic began more than two years ago.

"Agency bosses have their work cut out this year balancing welcome higher revenues against higher staff costs and higher staff churn," said Stickybeak co-founder David Brain. "Just like national economies, agencies are in an inflationary cycle. The good news is that of the agency leaders we polled nearly half (48%) are projecting income increases of more than 10% with one in 5 saying they will bill an incredible 25% more. Overall, the industry looks to be heading to at least a repeat of last years 11% income increase which is incredibly encouraging."

"This is just as well, given salary pressures mean 14% of PR leaders say they will be paying their people over 10% more this year, but it does look like revenue rises are outpacing people costs which implies the industry continues to grow in real terms."

Price rises rank ahead of supply chain challenges and misinformation, with Russia's invasion of Ukraine posing little concern to in-house respondents. In addition, customers outrank employees as the most important stakeholder group for clients, another finding that is a first since the start of 2020, as the chart below demonstrates.

"The big change for in-house teams this year seems to be the focus on customer communications which has leapt as a priority," added Brain. "The reasons are clear given that price rises (45%) and supply chain challenges (38%) were cited as their biggest communications challenges. If the Covid years were the era of employee first communications, then we now appear to be in the era of customer first communications."

C-Suite & services

Almost two-thirds of in-house respondents agree that the Covid crisis has improved the value of public relations in the corporate C-suite.

The benefits from this elevation in value may be here to stay, according to our respondents. Only 19% report that the value of the function has declined, now that the worst of the Covid crisis is over.

When it comes to specific services that clients are seeking from their PR firms, corporate comms remains on top, but there has been a strong rebound in consumer brand marketing.

That much is borne out by agency responses too.

Work & travel

Reinforcing the results of our previous research, the hybrid working model is here to stay, with more than half of respondents expecting three days or less in the office, and 30% allowing complete flexibility.

And it may well be that the nature of business travel has also changed. Only 15% report that travel is back to pre-Covid levels.

.jpg)