World Report 2015

Produced by the Holmes Report/ICCO, the World PR Report is the definitive study of the global PR industry, featuring rankings, insight and research.

Podcasts

PodcastsCatch the latest PR news & updates with PRovoke Media's PR Podcasts. Lifting the lid on key industry stories & trends, join our listeners of PR podcasts today.

Videos

VideosLatest video interviews and campaigns from PRovoke Media, previously known as the Holmes Report.

Long-form journalism that analyzes the issues, challenges and opportunities facing the business and practice of PR.

Profiles & Interviews

Profiles & InterviewsExplore PR profiles and interviews with leaders from the marketing and PR worlds.

Crisis Review

Crisis ReviewPR Crisis & Business Crisis review. PRovoke Media's annual analysis of the top reputation crises to rock the corporate sector. Read on here.

Coronavirus

CoronavirusPRovoke Media's coverage of the Covid-19 crisis, focusing on corporate communication, public affairs & PR industry fallout.

Trend Forecasts

Trend ForecastsPRovoke Media's PR Trends round up. PRovoke Media's annual forecast of PR trends and news that will impact the PR world in the year ahead...

Social & Digital

Social & DigitalDedicated to exploring the new frontiers of PR as it dives deeper into social media, content and analytics.

Technology

TechnologyOur coverage of key technology PR trends and challenges from around the world of digital communications.

Consumer

ConsumerFrom brand marketing to conscious consumerism, coverage of key marketing and PR trends worldwide.

Employee Engagement

Employee EngagementPRovoke Media's coverage, analysis and news around the rapidly-shifting area of employee engagement and internal communications.

Sports Marketing

Sports Marketing Sports PR news, diversity & inclusion trends, views and analysis from PRovoke Media. Subscribe today for the very latest in the world of sports communications.

Global PR Agency Rankings

Global PR Agency RankingsPRovoke Media's definitive global benchmark of global PR agency size and growth.

Enter PRovoke Media's 2024 Global 250 Agency Ranking and/or our Agencies of the Year competitions now.

Agencies of the Year

Agencies of the YearPRovoke Media's annual selections for PR Agencies of the Year, across all of the world's major markets.

Innovator 25

Innovator 25PRovoke Media profiles marcomms innovators from across North America, EMEA and Asia-Pac.

Creativity in PR

Creativity in PRIn-depth annual research into the PR industry's efforts to raise creative standards.

Asia-Pacific Communication Index

Asia-Pacific Communication IndexAPACD/Ruder Finn annual study of Asia-Pacific in-house communications professionals.

SABRE Awards

SABRE AwardsThe world's biggest PR awards programme, dedicated to benchmarking the best PR work from across the globe.

PRovokeSummit Global

PRovokeSummit GlobalThe biggest PR conference of the year, a high-level forum designed to address the critical issues that matter most.

PRovoke Media Regional Series

PRovoke Media Regional SeriesA global network of conferences that explore the innovation and disruption that is redefining public relations.

Agencies of the Year

Agencies of the YearUnrivalled insight into the world's best PR agencies, across specialist and geographic categories.

Roundtables

RoundtablesOur Roundtables bring together in-house comms leaders with PR firms to examine the future of communications.

Agency Playbook

Agency PlaybookThe PR industry’s most comprehensive listing of firms from every region and specialty

.jpg) All Jobs

All JobsFind the latest global PR and communications jobs from PRovoke Media. From internships to account executives or directors. See all our PR jobs here.

PRovoke Media's editorial series published in collaboration with partners.

Rankings: Top 10 | Top 250 | Fast Movers | Holding Groups/Networks

Analysis: Growth | Gender | CEO View

Research: Optimism | Opportunities | Challenges

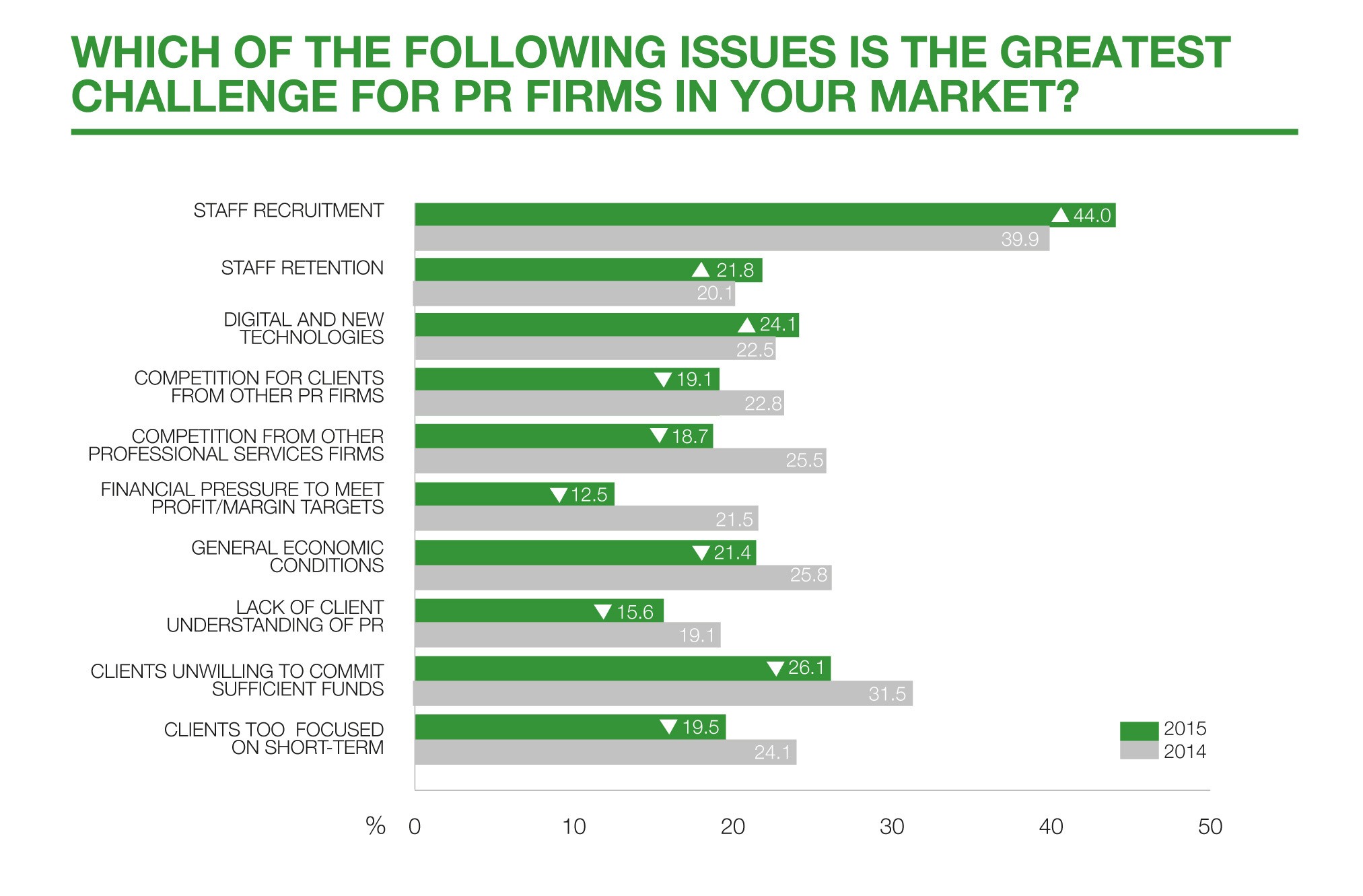

The ability to attract top talent is still the biggest concern for public relations agency leaders around the world, according to a survey conducted by The Holmes Report and ICCO (and powered by Newlio) as part of the World PR Report.

But there is growing concern about the willingness of clients to budget appropriately for successful public relations activity, and about the ability of public relations agencies to master digital media and other new communications technology.

This year, more than four out of 10 (44%) of consultancy principals around the world cited "staff recruitment" as one of the most significant challenges facing PR firms in their market. That was an increase over last year (39.9%).

At the same time, there was growing concern over the supply of "intelligent, well-educated talent" for PR agencies to recruit, with agency heads less confident (5.76, compared to 6.01 last year and 6.13 in 2013) that such a supply existed.

"Modern public relations requires a much more diverse set of skills," said Paul Holmes, founder and CEO of The Holmes Group, "and PR firms are increasingly worried about being able to find people with those skills. We have suggested several times that while PR is growing, it is not growing as fast as it could be given the new opportunities presented by the social and digital media revolution. It’s not unreasonable to suggest that the inability to find new people is holding us back."

"There is a definite war for talent going on right now, particularly ar wound the senior account manager/account director level. Employers should expect to see their wage bills increase in the short to medium term, as employees ask for more", said Francis Ingham ICCO chief executive and PRCA director general.

Concerns were strongest in Asia (5.43) and the Middle East (5.67) while only agency leaders in North America remained relatively sanguine (6.22) about the supply of talent.

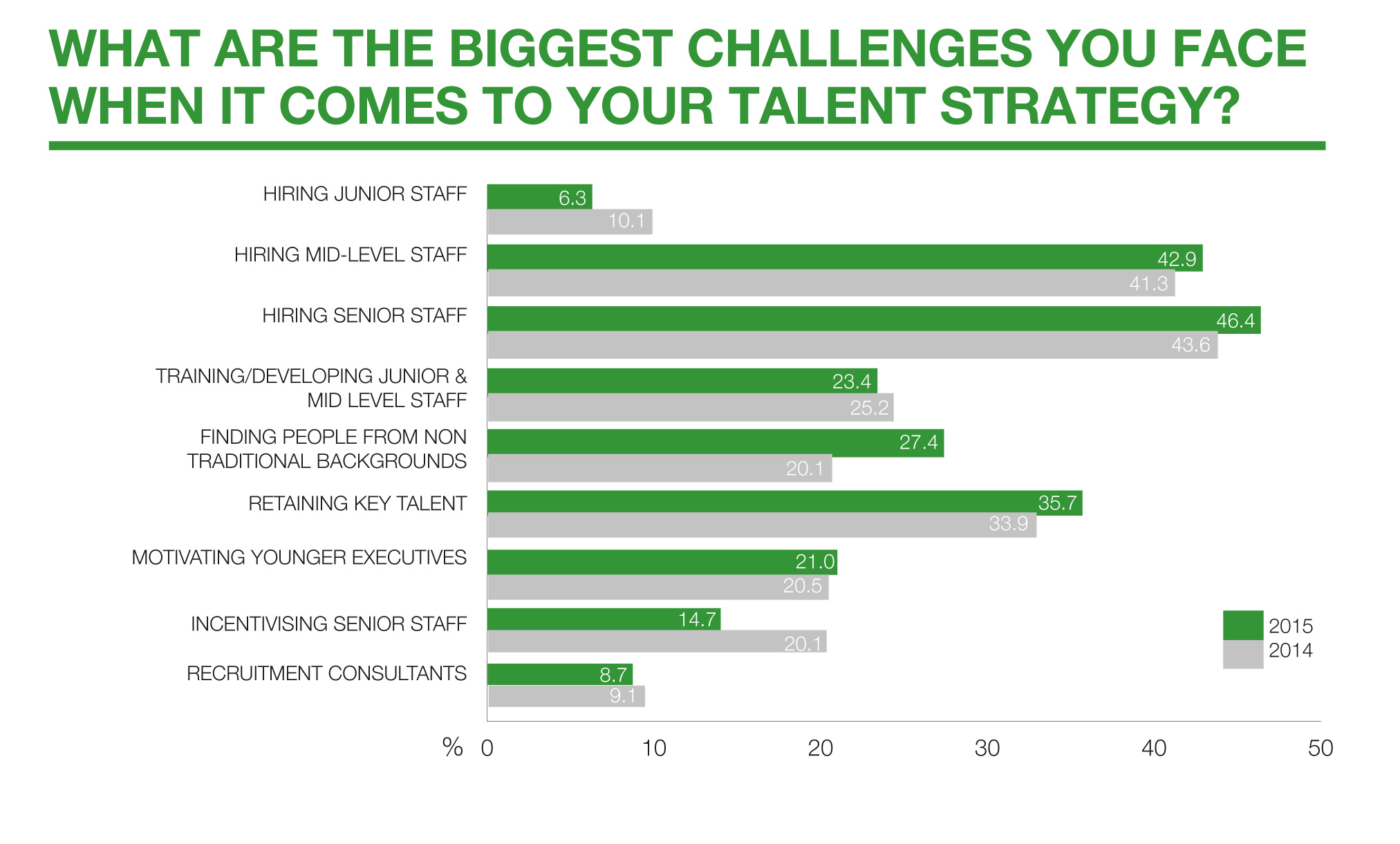

A paucity of senior staff was the greatest concern in terms of talent, cited by 46.4% of respondents globally, ahead of mid-level staff (42.9%). There was considerably less concern about the pipeline of junior staff, cited by just 6.3% of respondents.

Senior staff are most difficult to find in Eastern Europe (48.5%) but considerably more plentiful in Western Europe, where only 39.6% expressed concern about their ability to find top-level talent. Midlevel talent is a major concern for North American agencies (48.6%), those in the UK and Ireland (51.4%) and firms in Asia (52.3%), while junior talent is a much greater concern in Asia (9%) than in other markets.

Meanwhile, many firms continue to experience difficulty finding people from non-traditional backgrounds (27.4% globally), training and developing junior and midlevel staff (23.4%), and motivating younger employees (21%).

Finding people from non-traditional backgrounds is particularly problematic in Latin America (where 38.2% identified it as a major concern) but relatively easier in the UK and Ireland (25.3%). Motivating young people is most difficult in Asia (26.9%) but less of a challenge in North America (15.6%).

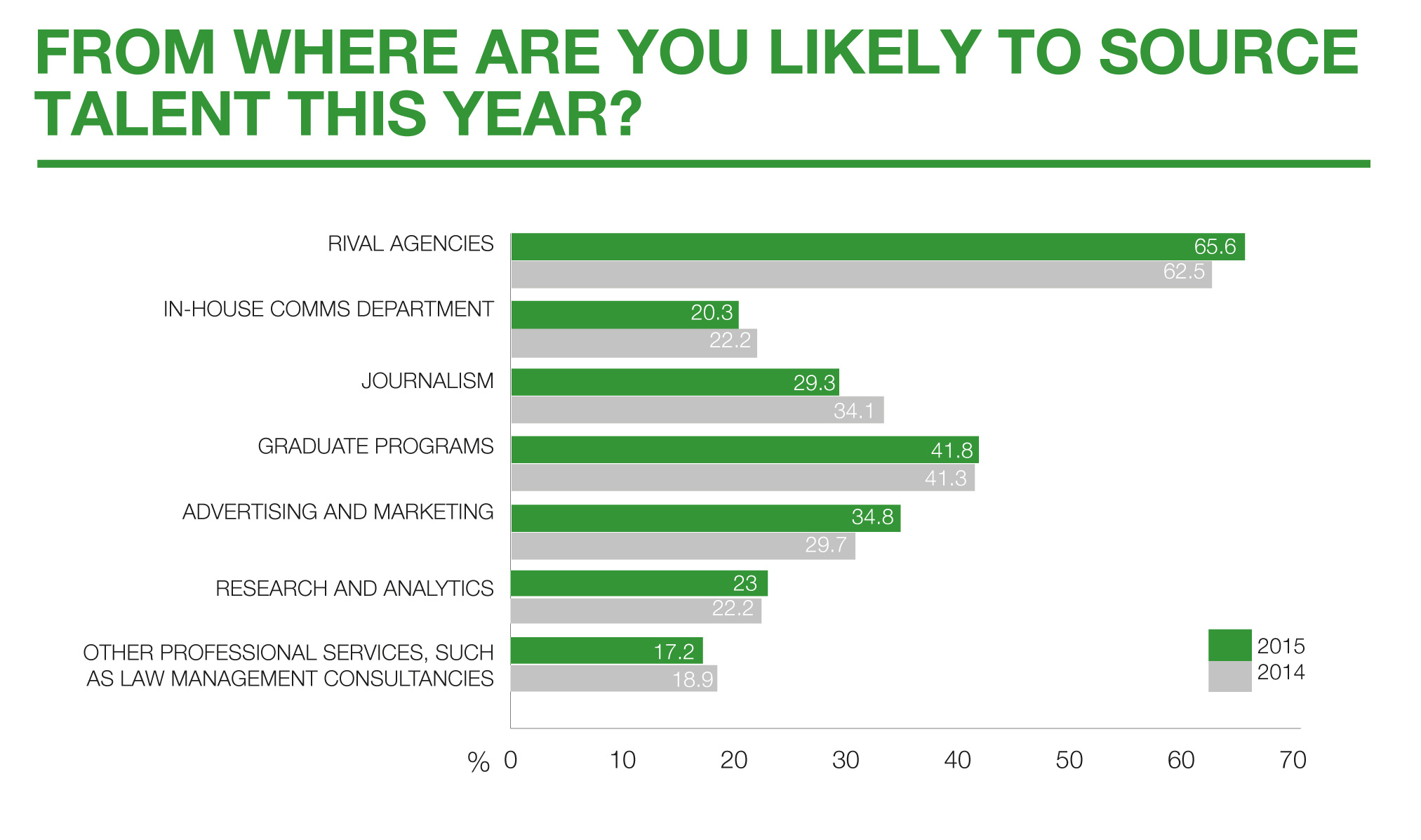

When it comes to sourcing new talent, most PR firms still find it easier to cannibalize their direct competitors—other PR agencies were identified as a key source by 65.6%—than to look elsewhere. Agencies in the UK and Ireland (81.7%) and North America (78.4%) were more likely to focus their recruitment on rival firms than those in less developed markets.

In terms of other sources, graduate programs (41.8%) were targeted by more firms than other advertising and marketing firms (34.8%), journalism (29.3%) and in-house communications departments (20.3%).

But more firms globally (23%) are looking to research and analytics for new talent—and interestingly, there is greater interest in developing markets such as Eastern Europe (31.9%), Asia (30.9%) and Latin America (30.4%) than in more developed parts of the world.

There is also more interest (17.2%) in looking to other professional services—management consultancy and law firms—for talent.

The biggest obstacle to recruiting from outside the industry, meanwhile, is economic: 50.2% of respondents say that expected salary levels make it difficult to bring in non-traditional talent, compared to 38.8% who worry about the lack of transferable skills and 25.5% who say potential recruits are just not interested.

The worry about salary levels is clearly related to PR agency principals’ second greatest concern—after recruitment—which is the reluctance of clients to commit to significant spending on PR, cited by 26.1% of respondents.

Among the factors perhaps influencing that reluctance: a continued concern about the general economic conditions (21.4%) and too much focus on the short-term (19.5%). The economy is a particularly big worry for firms in Eastern Europe (30.4%) while a short-term focus appears to be more of a problem in North America (21.4%).

Interestingly, concern about competition appears to be declining. Last year more than a quarter of responding firms (25.5%) cited competition from other marketing disciplines as a major obstacle to growth. Competition from other PR firms was cited by 19.1% this year, down from 22.8% last year.

More worrying is the concern that PR firms are not mastering digital and other new technologies, cited by 24.1% of respondents this year—and particularly worrying in Western Europe and the UK and Ireland—up from 22.5% of respondents this year.

On the other hand, it looks as though firms are making progress on measurement and evaluation: the difficulty of measuring PR efforts was cited by 11.7% of respondents this year, down from 13.8% last year and 17.5% the year before.

"Welcome as that news is, we do need to do more here. Strong evaluation skills are a prerequisite for PR success," said David Gallagher ICCO president and Ketchum EMEA CEO.

Rankings: Top 10 | Top 250 | Fast Movers | Holding Groups/Networks

Analysis: Growth | Gender | CEO View

Research: Optimism | Opportunities | Challenges

Produced by the Holmes Report/ICCO, the World PR Report is the definitive study of the global PR industry, featuring rankings, insight and research.

.tmb-135x100.jpg)

Intelligence and insight from across the PR world.

About PRovoke Media Contact Us Privacy & Cookie PolicyWe feel that the views of the reader are as important as the views of the writer. Please contact us at [email protected]

Signup For Our Newsletter Media Kits/Editorial Calendar Jobs Postings A-Z News Sitemap© Holmes Report LLC 2024