Podcasts

PodcastsCatch the latest PR news & updates with PRovoke Media's PR Podcasts. Lifting the lid on key industry stories & trends, join our listeners of PR podcasts today.

Videos

VideosLatest video interviews and campaigns from PRovoke Media, previously known as the Holmes Report.

Long-form journalism that analyzes the issues, challenges and opportunities facing the business and practice of PR.

Profiles & Interviews

Profiles & InterviewsExplore PR profiles and interviews with leaders from the marketing and PR worlds.

Crisis Review

Crisis ReviewPR Crisis & Business Crisis review. PRovoke Media's annual analysis of the top reputation crises to rock the corporate sector. Read on here.

Coronavirus

CoronavirusPRovoke Media's coverage of the Covid-19 crisis, focusing on corporate communication, public affairs & PR industry fallout.

Trend Forecasts

Trend ForecastsPRovoke Media's PR Trends round up. PRovoke Media's annual forecast of PR trends and news that will impact the PR world in the year ahead...

Social & Digital

Social & DigitalDedicated to exploring the new frontiers of PR as it dives deeper into social media, content and analytics.

Technology

TechnologyOur coverage of key technology PR trends and challenges from around the world of digital communications.

Consumer

ConsumerFrom brand marketing to conscious consumerism, coverage of key marketing and PR trends worldwide.

Employee Engagement

Employee EngagementPRovoke Media's coverage, analysis and news around the rapidly-shifting area of employee engagement and internal communications.

Sports Marketing

Sports Marketing Sports PR news, diversity & inclusion trends, views and analysis from PRovoke Media. Subscribe today for the very latest in the world of sports communications.

Global PR Agency Rankings

Global PR Agency RankingsPRovoke Media's definitive global benchmark of global PR agency size and growth.

Enter PRovoke Media's 2024 Global 250 Agency Ranking and/or our Agencies of the Year competitions now.

Agencies of the Year

Agencies of the YearPRovoke Media's annual selections for PR Agencies of the Year, across all of the world's major markets.

Innovator 25

Innovator 25PRovoke Media profiles marcomms innovators from across North America, EMEA and Asia-Pac.

Creativity in PR

Creativity in PRIn-depth annual research into the PR industry's efforts to raise creative standards.

Asia-Pacific Communication Index

Asia-Pacific Communication IndexAPACD/Ruder Finn annual study of Asia-Pacific in-house communications professionals.

SABRE Awards

SABRE AwardsThe world's biggest PR awards programme, dedicated to benchmarking the best PR work from across the globe.

PRovokeSummit Global

PRovokeSummit GlobalThe biggest PR conference of the year, a high-level forum designed to address the critical issues that matter most.

PRovoke Media Regional Series

PRovoke Media Regional SeriesA global network of conferences that explore the innovation and disruption that is redefining public relations.

Agencies of the Year

Agencies of the YearUnrivalled insight into the world's best PR agencies, across specialist and geographic categories.

Roundtables

RoundtablesOur Roundtables bring together in-house comms leaders with PR firms to examine the future of communications.

Agency Playbook

Agency PlaybookThe PR industry’s most comprehensive listing of firms from every region and specialty

.jpg) All Jobs

All JobsFind the latest global PR and communications jobs from PRovoke Media. From internships to account executives or directors. See all our PR jobs here.

PRovoke Media's editorial series published in collaboration with partners.

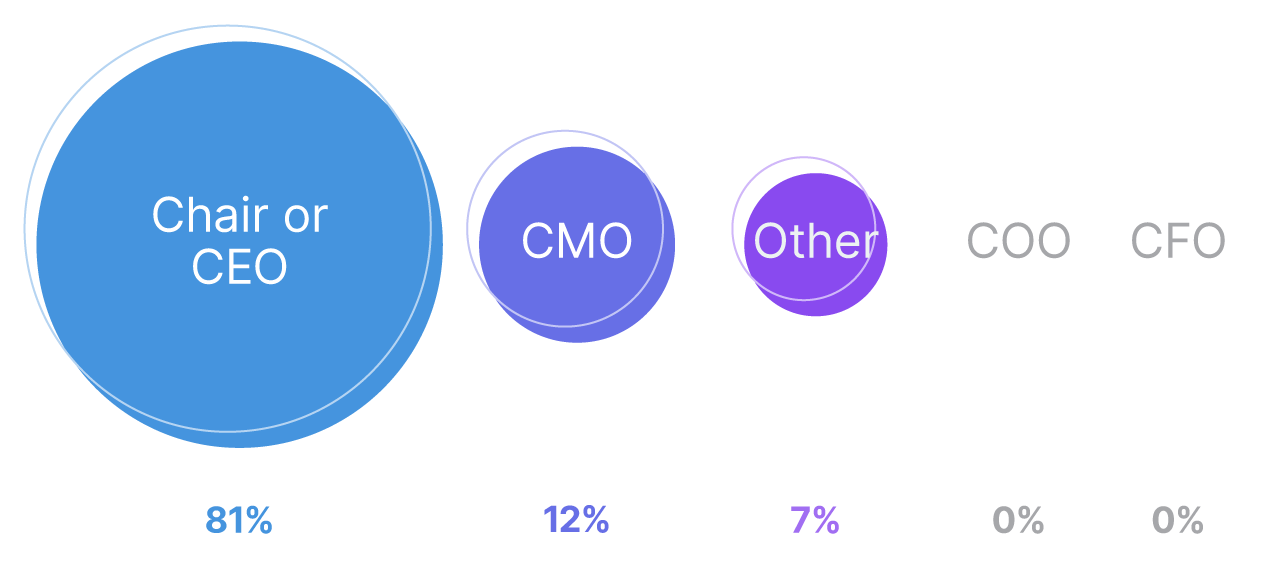

The number of CMOs and CCOs reporting to the chief executive or chair of their organization is even higher this year, a whopping 81% compared to 72% last year and 73% in 2020. This rise seems to have come at the expense of the chief operations officer and chief financial officer roles, as none of our Influence 100 report into either of these roles. Last year, the figure was 6% for COO and 2% for CFO. Oversight by the chief marketing officer rose too, by just one per cent compared to last year. And 7% of the cohort report into other functions such as corporate relations director and chief impact officer.

This year, our Influence 100 cohort control a PR spend of more than $4.8bn, an increase on last year’s $4.7bn and far ahead of 2020’s dip to $4.2bn. There is still a while to go, however, to reach the heady levels of $6.5bn recorded when we launched this survey in 2012.

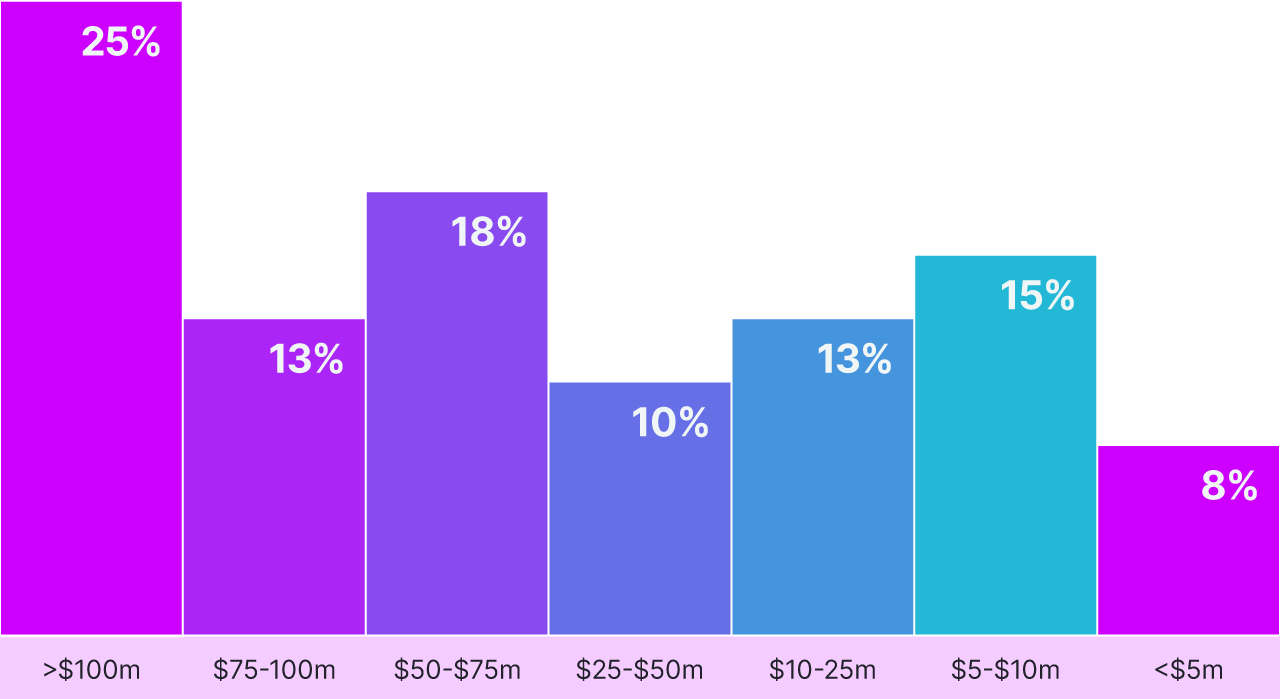

Despite the overall rise, there was a dip in the number of our overall Influence 100 managing budgets of more than $100m. Last year the figure was 27%, this year it was 25%. The number of CMOs and CCOs managing between $75 and $100m grew, however, from 11% last year to 12.5% in 2022. And the next budget bracket, $50-$75m, also leaped from 14% to 17.5%.

At the bottom end, the percentage handling budgets under $5m almost halved, from 14% in 2021 to 7.5% this year, and there was an almost corresponding rise in those managing $5-$10m, up to 15% compared to 9% last year.

Overall around 40% of respondents said their budget had remained flat this year – last year almost half had experienced no movement in their budgets. A robust 46% reported an increase in budget of between 5 and 20%. Just 7% said budgets were down, by between 5 and 15%. The remaining 7% said budgets had increased substantially, between 30 and 50% year on year.

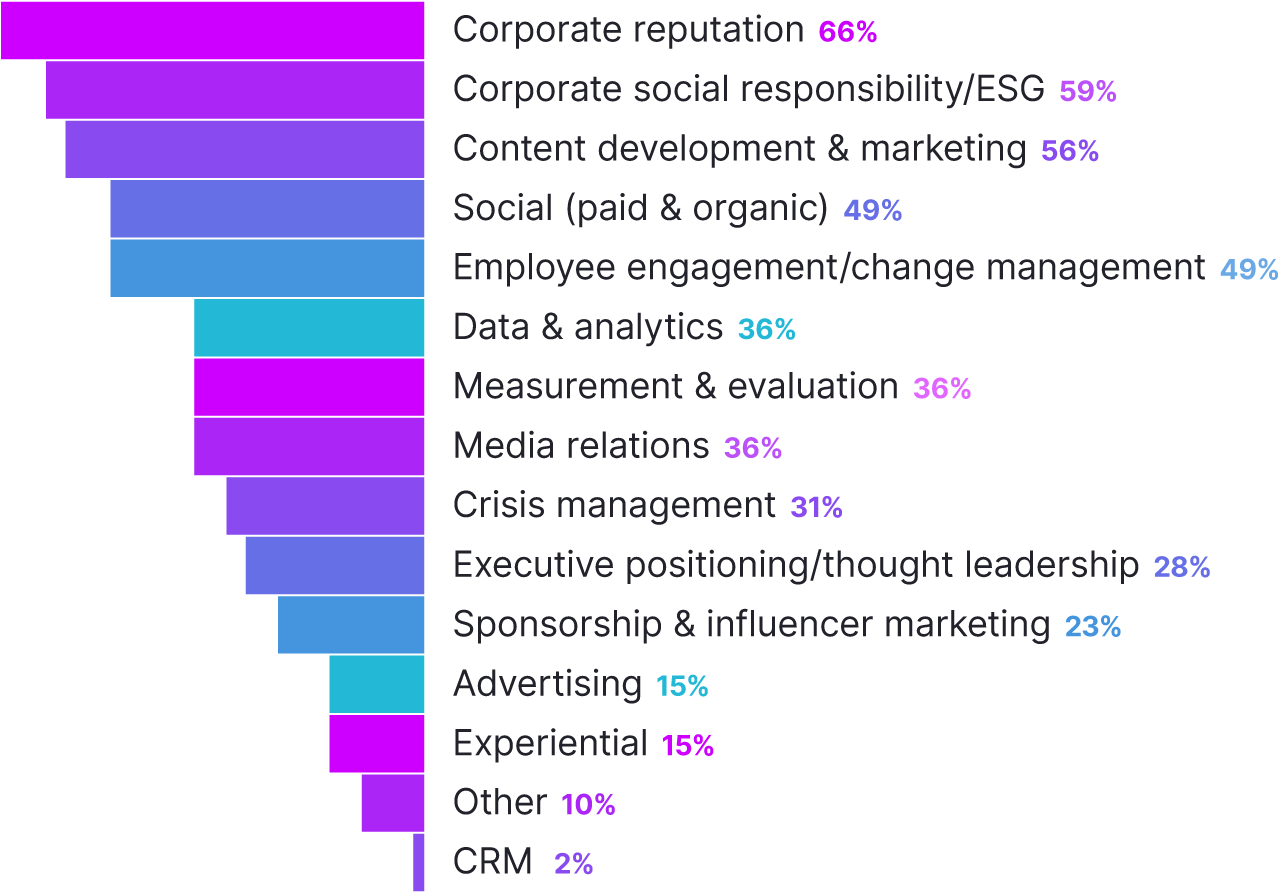

There are big changes ahead for spending priorities for our Influence 100. Although corporate reputation remains the top budget priority, up one per cent from last year to 66%, the new category of corporate social responsibility/ESG is set to be a major area of spend, at 59%. This reflects a growing focus in both the industry and the wider landscape on environmental and social issues. Content development and marketing has also jumped up the list, up from a priority area for 46% last year to 56% in 2022.

Social media, by turn, has decreased as a priority spending area. Last year it was second on the list, as a priority for 60%, this year it has slipped to joint fourth alongside employee engagement and change management, both at 49%.

Other areas of note include data and analytics, and measurement and evaluation which are both at 35% alongside media relations. Crisis management has increased fairly dramatically, up from 17% last year to 31% this year. Advertising, meanwhile, has slipped down the list, from 23% last year to 15% this year.

CRM was the least important spending area for our respondents, holding steady at 2%, the same as last year. But ‘other’ areas, such as public affairs, research and alliances/partnerships, have become more important, up to 10% compared to just 2%, and joint bottom of the list, last year.

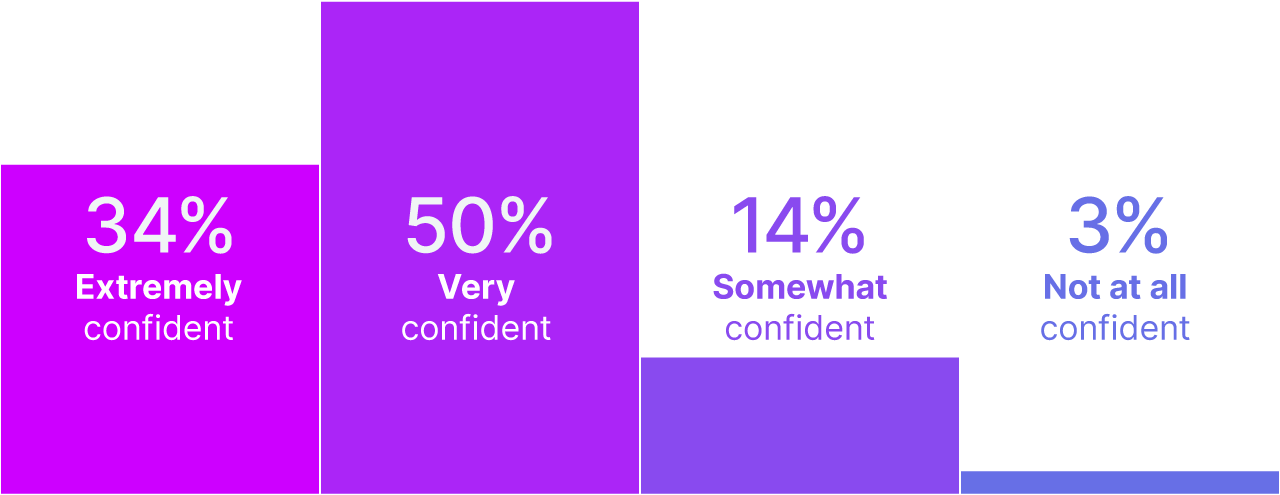

Has confidence in the resilience of the sector they operate in slipped for our CCOs and CMOs? The data suggests so, with just 33.5% saying they feel extremely confident compared to a reassuring 51% last year. Those feeling very confident, however, increased from 40% to 50%, and so did those feeling somewhat confident, up from 9% to 14%. Perhaps most worryingly, 2.5% of respondents said they didn’t feel confident, and this figure was zero last year.

Has confidence in the resilience of the sector they operate in slipped for our CCOs and CMOs? The data suggests so, with just 33.5% saying they feel extremely confident compared to a reassuring 51% last year. Those feeling very confident, however, increased from 40% to 50%, and so did those feeling somewhat confident, up from 9% to 14%. Perhaps most worryingly, 2.5% of respondents said they didn’t feel confident, and this figure was zero last year.

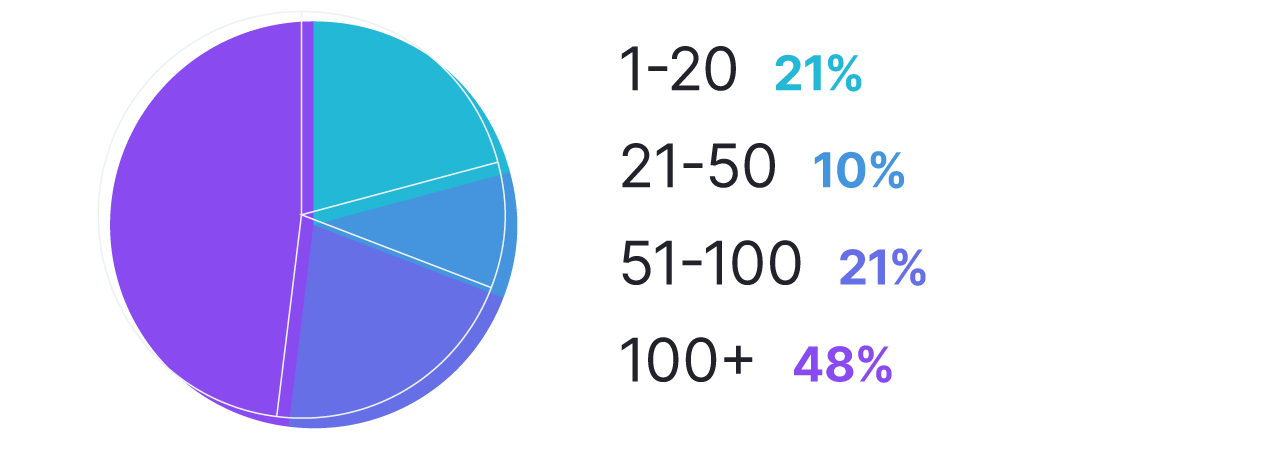

For the last few years, we’ve seen a steady rise in the number of our CCOs and CMOs managing teams of more than 100 people, but this year the trend has stalled and in fact, the number has decreased slightly to 48% compared to 52% last year. The number managing teams from 51-100 also slipped to 21%, down from 23% last year. Conversely, the number left with teams of just 1-20 almost doubled, up from 12% last year to 21% this year.

In total 45% of respondents said their team had stayed the same size as last year, and a further 45% said their team size had increased by 5 and 25%. Only 5% said their team had shrunk.

When asked about working models, hybrid working remained the norm for the overwhelming majority – 84%, although this compares to an even more overwhelming majority of 92% last year. Just 7% were back in the office full time. And interestingly, although none of our respondents said they were anticipating a mostly or fully remote working model last year, this year 9% stated that their current model was indeed mostly remote, although none were fully remote.

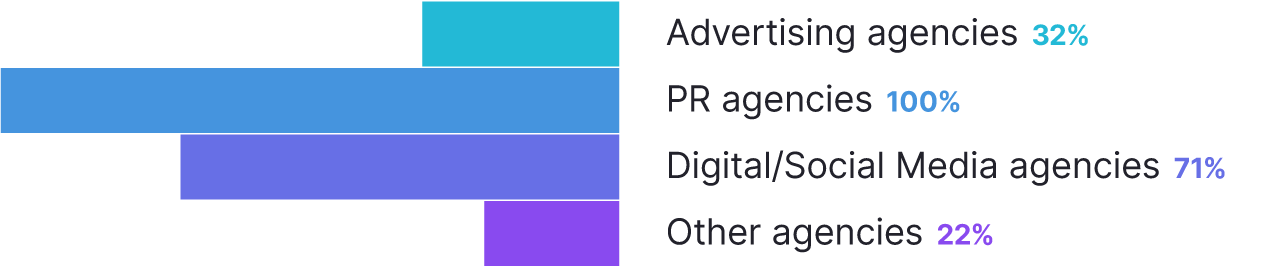

Our Influence 100 have a say over much more than just public relations – for which 100% are responsible for hiring. As per last year, the vast majority of respondents, up to 71% from 69% in 2021, are the primary decision-makers for digital and social media agencies. Some 32% have responsibility for advertising agencies, although this figure is down significantly from last year’s 41%. Other specialist agencies managed by our cohort included brand, content, ESG, research, public affairs, data and insight, measurement and design.

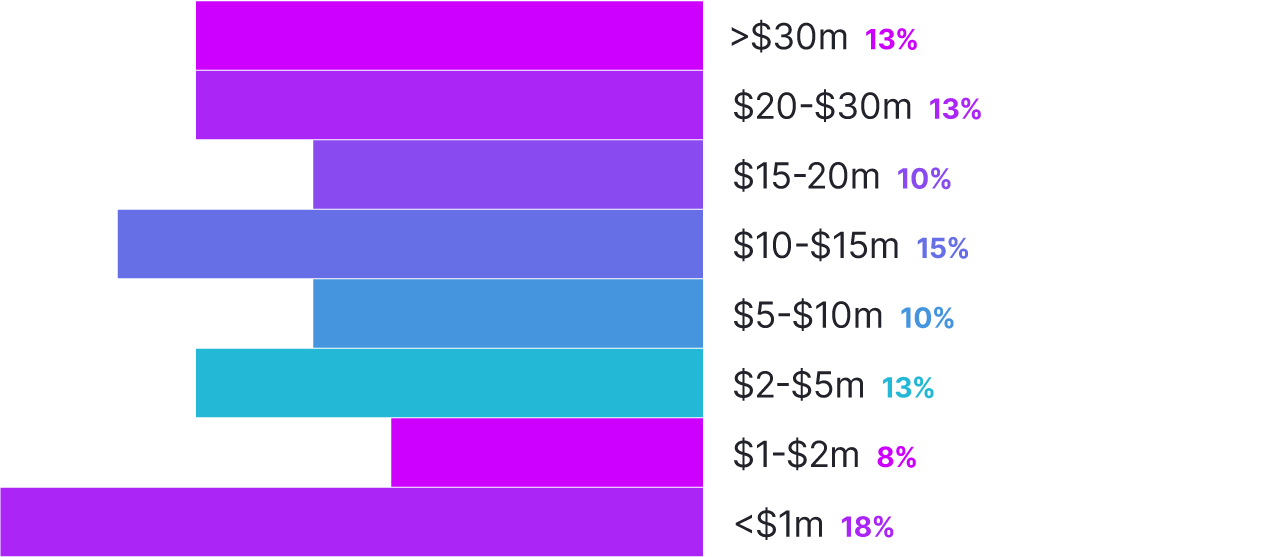

Agency spend has stalled ever so slightly since last year, when a full 30% were spending more than $20m on their PR agency partners. This year the figure has dropped to 26%, with a further 25% spending between $10 and $20m compared to 16% last year. At the lower end, 18% of respondents were spending less than $1m, slightly up from 16% last year, and 8% were spending $1-$2m, slightly up on 7% last year but well down from 24% in 2020.

There has been a huge change in the way CMOs and CCOs work with their agencies in the last 12 months if our data is anything to go by. A full 16% now say they have one global agency of record – in 2021, this figure was just 2%. And the number of respondents working with firms on a project basis has dropped considerably, from 34% last year to 22% this year. The percentage with a global AOR who also work with other firms dipped only slightly to 36% compared to 39% last year, and the number with separate AORs in each region dropped from 14% to 12%.

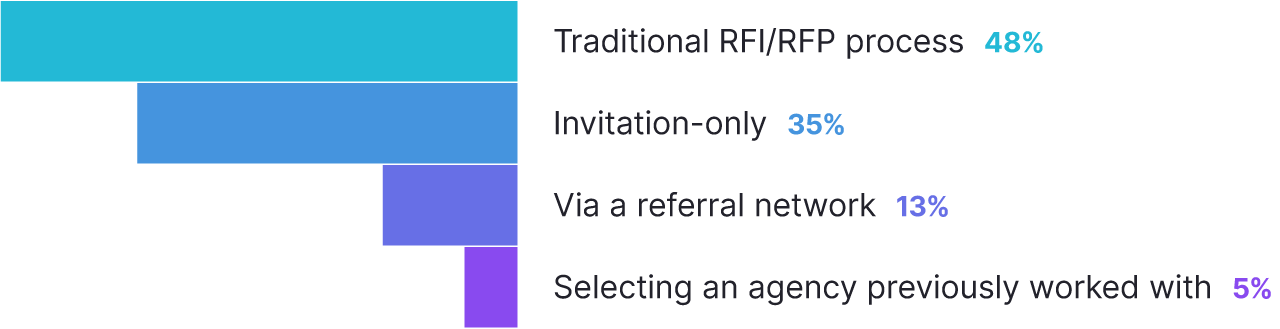

The number of CCOs and CMOs who prefer to hire agencies via a traditional RFP pitch process continued to increase, up to 47.5% this year compared to 45% last year and 32% in 2020. Meanwhile the number who prefer an invitation-only process continued to fall, down to 35% compared to 39% last year and a whopping 52% the year before. And a final trend that continued to drop was the number of respondents preferring to hire an agency they’ve worked with previously – 5% this year, down one from 6% last year and 9% in 2020.

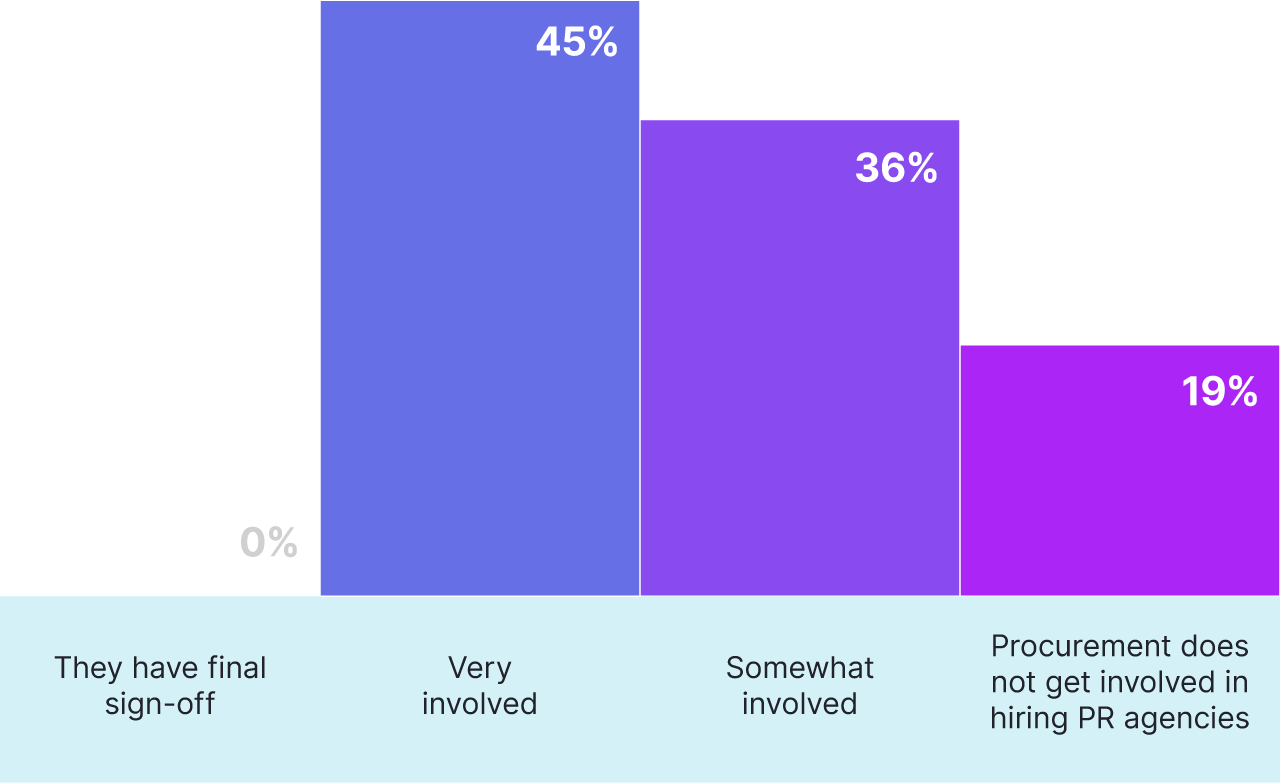

We also asked our influencers what role procurement plays in their organization when it comes to hiring PR agencies. 81% said procurement was somewhat or very involved, almost reaching 2019 levels of 83% after a two-year dip. And 19% said procurement doesn’t get involved in hiring PR agencies, down from 20% last year.

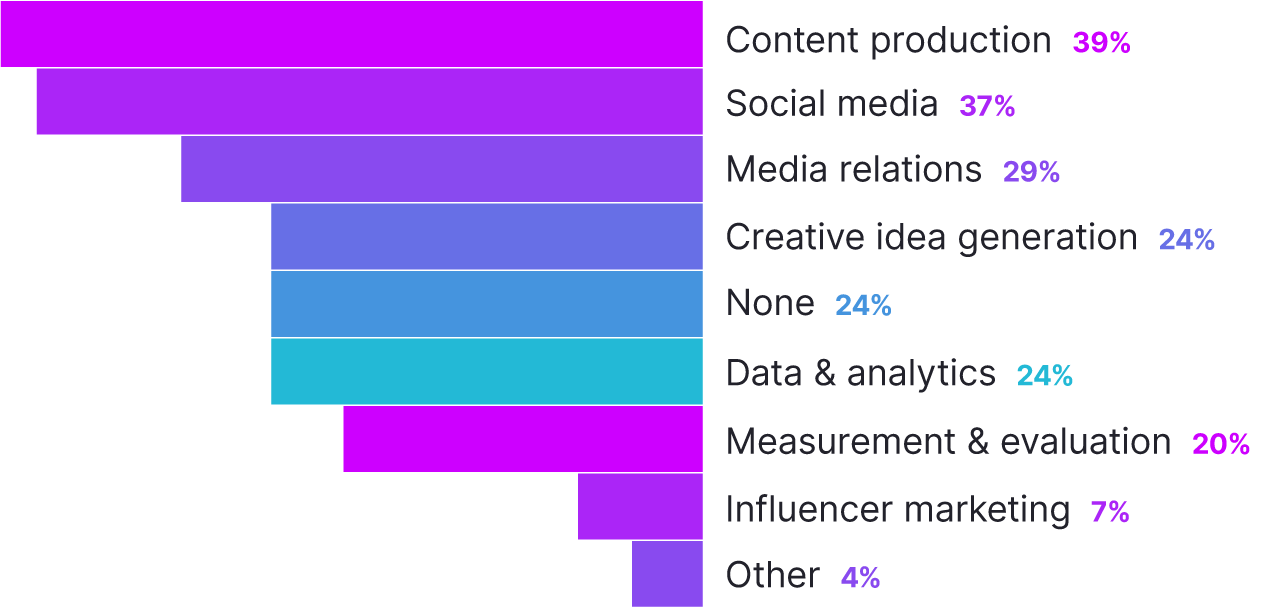

This is only the second year we’ve asked our leaders which agency services they would be looking to bring in-house, but we’ve already seen significant changes. A full 39% said they would be looking to bring content production in-house, compared to 28% last year. In fact last year the largest proportion, 30%, said they wouldn’t be looking to bring any services in-house. This year the figure was down to 24%. Bringing social media in-house is on the agenda for 37%, up from 30% last year, and media relations is a priority for 29%. Nearly a quarter, meanwhile, are pondering bringing creative idea generation in-house, up from 18% last year and the same proportion, 24%, are looking at bringing data and analytics in-house. Influencer marketing remained a less interesting option, with just 7% thinking of bringing it in-house. Other options included research and martech.

Once again, this is only the second year we’ve asked our Influence 100 how satisfied they are with their PR agency partners. The proportion that said they were very satisfied dropped from 45% in 2021 to 37% this year, and there was a corresponding rise in the number who said they were reasonably satisfied, up to 61% from 53% last year. For the second year running, just 2% said they weren’t at all satisfied.

Tactical and execution support remains the biggest benefit to working with a PR agency for 35% of our influencers, but this is a huge drop compared to 2021’s 51%. Strategic counsel, meanwhile, was named the biggest benefit to working with a PR agency for 30% of our influencers, a jump from 20% last year despite the crisis of the pandemic having largely passed. Creative thinking also continued to rise, up to 27.5% from 25% last year, although there is still a way to go to reach 2019 levels of 36% of influencers valuing this benefit above all others.

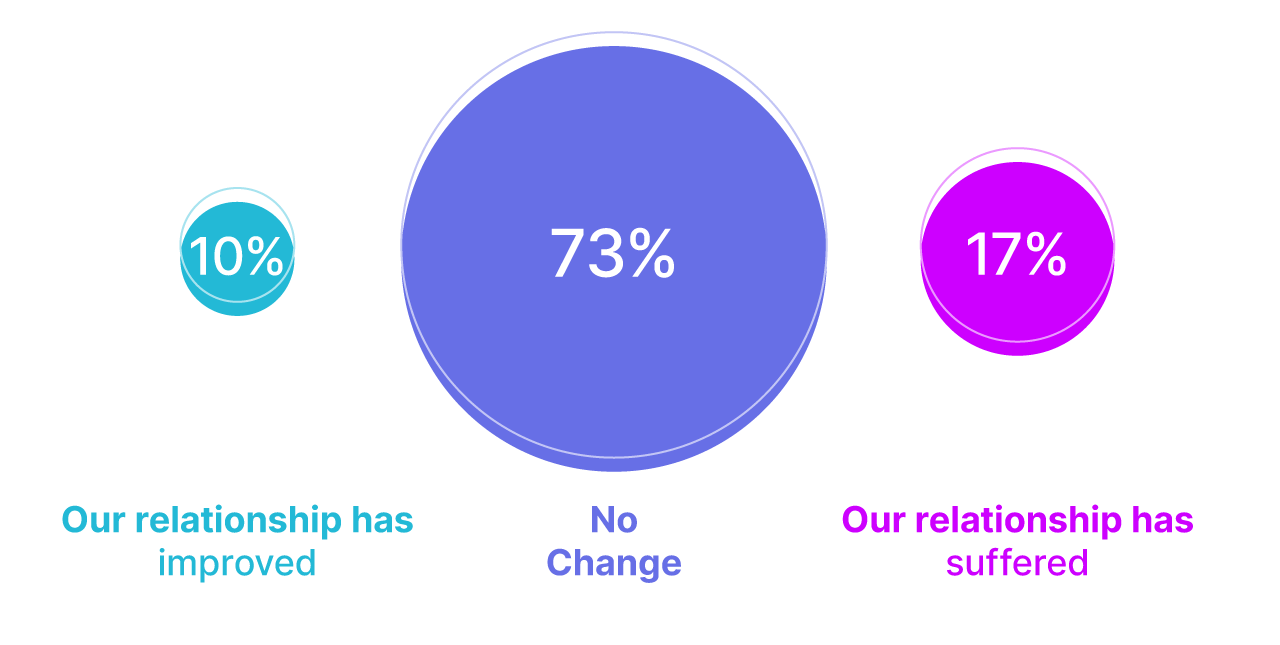

Our final two questions concern how relationships and expectations have changed over the course of the pandemic. The proportion of influencers saying their relationship with PR agencies had suffered due to remote working rose from 10% last year to 17%, suggesting that Zoom isn’t always the way forwards. By turn, the number who felt their relationship had not changed fell slightly from 80% to 73%, and those who felt relationships had actively improved stayed stable at 10%.

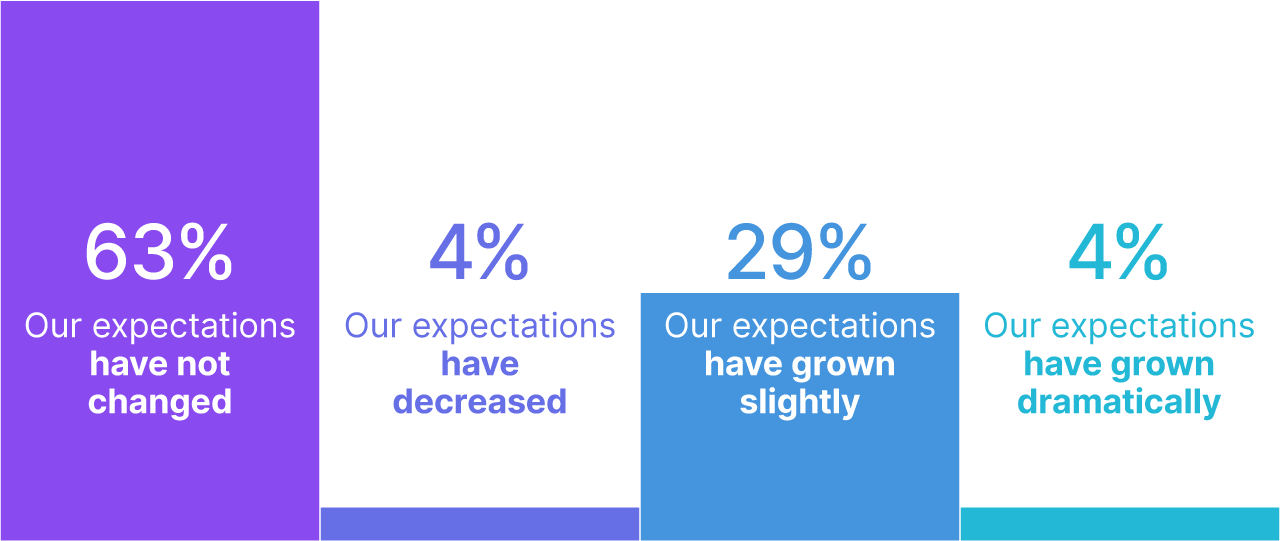

In terms of expectations, those who felt their expectations hadn’t changed as a result of Covid leaped up from 47% last year to 63% this year. Just 4% said their expectations had dramatically grown, compared to 12% last year, and 29% said expectations had grown slightly. There was a small slump in the number of respondents who felt expectations had decreased as a result of Covid, at 4% this year compared with 6% last year.

Intelligence and insight from across the PR world.

About PRovoke Media Contact Us Privacy & Cookie PolicyWe feel that the views of the reader are as important as the views of the writer. Please contact us at [email protected]

Signup For Our Newsletter Media Kits/Editorial Calendar Jobs Postings A-Z News Sitemap© Holmes Report LLC 2024